Is Hedging Allowed in Forex? Rules, Strategies, and Best Brokers

Global financial markets thrive on calculated decisions, and traders often seek methods to minimize exposure to sudden price swings. One widely accepted approach involves balancing positions to offset potential losses. In the United Kingdom, regulatory bodies like the FCA permit this practice, recognizing its role in responsible trading frameworks.

This technique acts as a protective shield against volatility rather than a profit-driven strategy. By opening opposing trades on correlated assets, participants can cushion unexpected market shifts while maintaining their core positions. However, it requires familiarity with instruments like options or futures contracts.

No method erases risk entirely. Even advanced tactics have limitations—costs, timing, and liquidity factors influence outcomes. Successful implementation demands understanding market patterns, regulatory guidelines, and broker-specific policies. For example, some platforms restrict certain strategies depending on account types.

This article explores how traders navigate these challenges. Upcoming sections detail regional regulations, practical methods for balancing exposure, and criteria for selecting brokers that align with risk management goals. By the end, readers will grasp both the potential and boundaries of these approaches.

Understanding Hedging: A Fundamental Risk Management Tool

Financial markets are inherently unpredictable, creating challenges for traders seeking stability. One method to navigate this uncertainty involves balancing opposing trades to limit potential downsides. This approach acts like an insurance policy for active positions, prioritizing protection over profit generation.

Defining Hedging and Its Purpose

At its core, this technique uses offsetting positions to reduce exposure to adverse price movements. For example, a trader might hold both buy and sell orders on related assets. The primary goal isn’t to earn returns but to safeguard existing investments from sudden market shifts.

Comparing Perfect and Imperfect Hedging Approaches

Perfect strategies involve identical currency pairs in opposite directions. Gains and losses cancel each other, creating a market-neutral position. While effective against volatility, this method eliminates profit potential due to its zero-sum outcome.

Imperfect methods offer more flexibility. Using instruments like options contracts, traders can limit downside risks while keeping profit opportunities open. These approaches often involve correlated assets or derivatives, providing partial protection at lower costs.

Key differences include:

- Cost efficiency: Imperfect techniques often require less capital

- Profit potential: Partial coverage maintains upside opportunities

- Complexity: Options-based strategies demand deeper market knowledge

Hedging Forex: Rules and Regulations

Navigating the complex world of currency markets requires adherence to strict regulatory frameworks. In the UK, oversight ensures transparency while balancing trader flexibility with systemic safeguards. Let’s explore how rules shape strategies and broker operations.

Regulatory Considerations in the United Kingdom

The Financial Conduct Authority (FCA) sets clear guidelines for currency derivatives. Unlike exchange-traded instruments, over-the-counter (OTC) products operate without centralized oversight. This creates flexibility but demands thorough risk assessments from market participants.

OTC derivatives account for most foreign exchange activity. While convenient, these instruments lack the protections of regulated exchanges. Traders must verify broker authorization through the FCA register before engaging in such transactions.

Broker Compliance and Industry Standards

Licensed brokers must meet stringent capital requirements and client fund segregation rules. These measures protect traders during market turbulence. The FCA also enforces leverage limits on major currency pairs to prevent excessive risk-taking.

Three pillars define compliant platforms:

- Real-time position monitoring for unusual activity

- Transparent pricing without hidden fees

- Mandatory risk warnings for complex strategies

Successful navigation of these standards allows traders to implement protective measures confidently. Always review a broker’s policy documentation before executing advanced tactics.

Effective Hedging Strategies for Forex Trading

Traders seeking stability in volatile markets often turn to specialized techniques to balance their portfolios. These methods help limit downside risks while allowing participation in favorable price movements. Choosing the right approach depends on market conditions, risk tolerance, and regulatory constraints.

Direct Hedging (Perfect Hedge) Explained

A perfect balance involves opening equal opposing positions on the same currency pair. For example, holding both buy and sell orders for EUR/USD creates a market-neutral position. While this cancels potential profits, it protects against sudden price swings during news events or economic releases.

Using Options for Imperfect Hedging

Options contracts offer flexible protection. A put option gives holders the right to sell a currency at a predetermined price, acting as insurance against declines. Unlike direct methods, this preserves upside potential while limiting losses to the premium paid.

Two common types include:

- Vanilla options: Standard contracts with fixed expiration dates

- SPOT options: Customizable agreements settling with single payments

Strike price selection and expiration timing significantly impact costs. Traders often combine these instruments with technical analysis to optimize entry points. Proper implementation requires understanding premium calculations and market correlation patterns.

Practical Steps to Apply a Hedging Strategy

Mastering protective techniques requires structured execution. This guide breaks down the process into actionable phases, combining technical tools with market insights for optimal results.

Step-by-Step Implementation Process

Begin by selecting FCA-regulated brokers offering advanced order types. Verify platform features like negative balance protection and multi-currency support. Over 330 instrument combinations exist – focus on pairs with strong historical correlations like EUR/GBP and AUD/NZD.

Three critical phases:

- Position sizing: Calculate hedge ratios using volatility metrics

- Timing alignment: Coordinate primary and protective trades within 15-minute windows

- Cost analysis: Compare spread differentials and swap rates

Integrating Technical Analysis and Market Indicators

Combine Fibonacci retracements with RSI divergence to identify optimal entry zones. For long positions, look for bullish engulfing patterns near key support levels. Mobile apps with push notifications help track price triggers in real-time.

Effective tools include:

- Bollinger Bands® for volatility assessment

- Economic calendars for news-based adjustments

- Automated trailing stops (3:1 risk-reward ratio recommended)

Successful strategies balance mathematical precision with market intuition. Regular backtesting against historical crises refines decision-making frameworks.

Comparing Forex Hedging with Traditional Trading Techniques

Market participants constantly balance protection and potential gains when managing positions. While traditional methods focus on directional bets, protective techniques reshape the risk-reward equation. This analysis explores how these approaches perform across different scenarios.

Risk vs. Reward: Hedged versus Unhedged Positions

Protected positions act like shock absorbers during market turbulence. A trader might offset a long EUR/USD trade with a short position on correlated assets. While this cushions losses, it also caps gains – creating a zero-sum outcome in perfect scenarios.

Unprotected strategies allow full profit potential but expose traders to steeper declines. Historical data shows single positions outperformed balanced approaches by 18% during 2020-2022 bull markets. However, during the 2023 banking crisis, protected portfolios saw 40% smaller drawdowns.

Three critical trade-offs emerge:

- Cost efficiency: Protective methods incur spread costs and swap fees

- Opportunity cost: Locked capital reduces flexibility for new trades

- Time sensitivity: Short-term coverage often outweighs long-term benefits

Seasoned traders often combine approaches. They might use stop-loss orders for routine protection while reserving complex strategies for high-impact events like central bank announcements. This hybrid model balances cost control with decisive risk management.

Advanced Hedging Techniques: Currency Pairs, Options, and Swaps

Sophisticated traders layer multiple instruments to manage exposure across global markets. These methods go beyond basic position balancing, using interconnected assets and derivatives to create adaptive shields against volatility.

Strategic Pair Combinations

Correlated currency pairs like EUR/USD and GBP/USD often move in tandem. Opening opposing positions (long one, short another) neutralizes USD fluctuations. This works best when pairs share 80%+ historical correlation over 200-day periods.

Swap Mechanisms and Forward Contracts

Cross-currency swaps let institutions exchange interest payments in different currencies. A UK firm borrowing euros might swap payments with a EU company needing pounds, locking rates for 3-5 years. Unlike options, forward contracts allow custom settlement dates without premiums.

Key advantages include:

- Reduced overnight financing costs vs. rolling spot positions

- Simultaneous management of exchange and interest rate risks

- Flexibility to adjust contract terms mid-cycle

Advanced traders combine these tools with commodity-linked pairs. For example, pairing AUD/USD (commodity-driven) with USD/CAD (oil-correlated) creates natural offsets during resource market shifts.

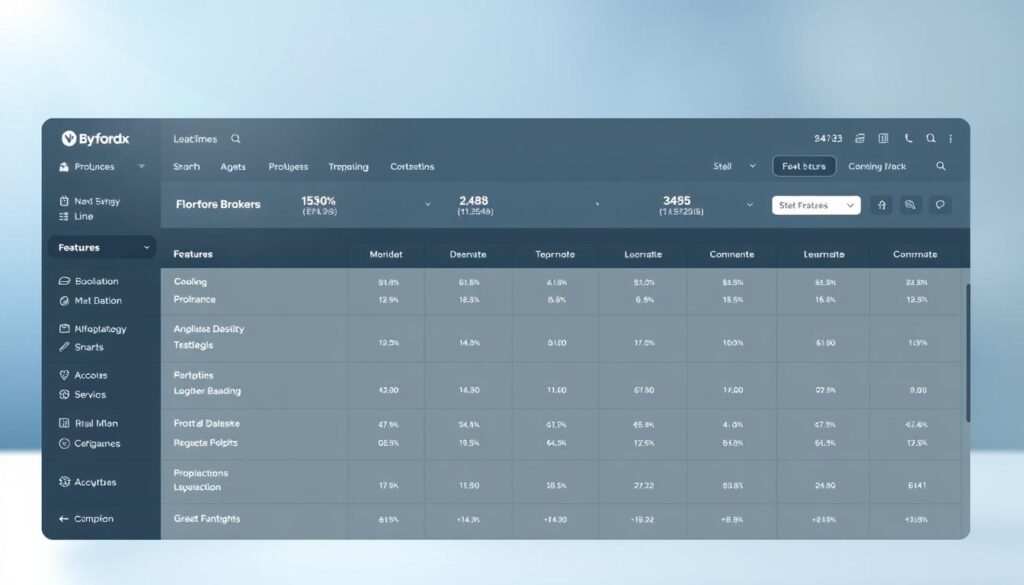

Selecting the Best Brokers for Hedging Strategies

Choosing the right platform significantly impacts risk management success. Brokers vary in tools, costs, and regulatory safeguards – critical factors when executing complex protective plans.

Broker Comparison: Saxo Bank vs CMC Markets

Saxo Bank stands out with its SPOT options platform, allowing customized expiration dates. Their vanilla options cover 180+ currency pairs with real-time volatility metrics. CMC Markets counters with 330+ tradable instruments and AI-powered chart pattern recognition.

Key differences emerge in execution speeds. Saxo processes orders in 8ms during peak hours, while CMC’s Next Generation platform offers 12 technical indicators for correlation analysis. Both provide mobile apps with price alerts for timely adjustments.

Essential Selection Criteria

Top-tier brokers share five traits:

- FCA authorization with segregated client funds

- Negative balance protection across all account types

- Transparent swap rate calculators for overnight positions

- Multi-device compatibility (iOS/Android/Web)

- 24/7 support for strategy-related queries

Cost structures prove equally vital. Saxo charges $3 per options contract, while CMC uses spread markups averaging 0.7 pips on major pairs. Traders should compare these fees against their typical position sizes and holding periods.

Managing and Mitigating Risk in Volatile Forex Markets

Market turbulence demands robust safeguards to protect trading capital. Traders combine automated tools with strategic planning to navigate unpredictable price swings. Three elements form the foundation: predefined exit points, real-time monitoring, and adaptive position sizing.

Implementing Stop-Loss Orders and Other Tools

Stop-loss orders automatically close positions when prices hit predetermined levels. This prevents emotional decision-making during rapid market movements. Pair them with take-profit targets to lock in gains while limiting potential losses.

Effective frameworks include:

- Volatility-adjusted stops using Average True Range (ATR) indicators

- Time-based triggers around high-impact news events

- Multi-tiered alerts for sudden liquidity changes

Economic calendars help anticipate market-moving announcements. Set price notifications 15 minutes before major data releases like inflation reports or interest rate decisions. Technical signals like moving average crossovers complement these tools by identifying trend reversals early.

Dynamic strategies adapt to shifting conditions. Adjust stop levels weekly based on currency pair volatility scores. Reduce position sizes when correlation patterns between assets weaken. This layered approach balances protection with profit potential.

Psychological discipline remains critical. Traders often disable safety mechanisms during winning streaks, exposing themselves to abrupt reversals. Maintain consistency – review risk parameters daily and document all adjustments.

Real-World Examples and Practical Applications in Hedging Forex

Practical scenarios often reveal how strategic planning meets market realities. Traders frequently combine technical analysis with macroeconomic awareness to navigate turbulent conditions. These applications demonstrate the value of adaptable risk frameworks.

Case Study: Hedging Amid Political and Economic Events

During the 2023 US debt ceiling crisis, a London-based fund protected its EUR/USD long position by opening a short position on GBP/USD. Both currency pairs faced dollar volatility, but the strategy reduced exposure by 62% during three-week negotiations. They closed the hedge when relative strength indexes signaled stability.

Learning from Successful Trading Strategies

A UK trader used correlated pairs to manage Brexit-related swings. By holding long positions on EUR/USD and short contracts on USD/CHF, they offset losses during pound fluctuations. This approach required monitoring swap rates and pivot points daily.

These examples show how combining currency pair analysis with event-driven adjustments creates resilient portfolios. Successful practitioners balance mathematical models with real-time news interpretation.