Gold ETF: How to Invest in Gold Exchange-Traded Funds

For centuries, precious metals have served as a trusted store of value. Today, exchange-traded funds simplify access to this timeless asset class. Modern investors now bypass physical storage challenges through innovative financial instruments that mirror gold’s price movements.

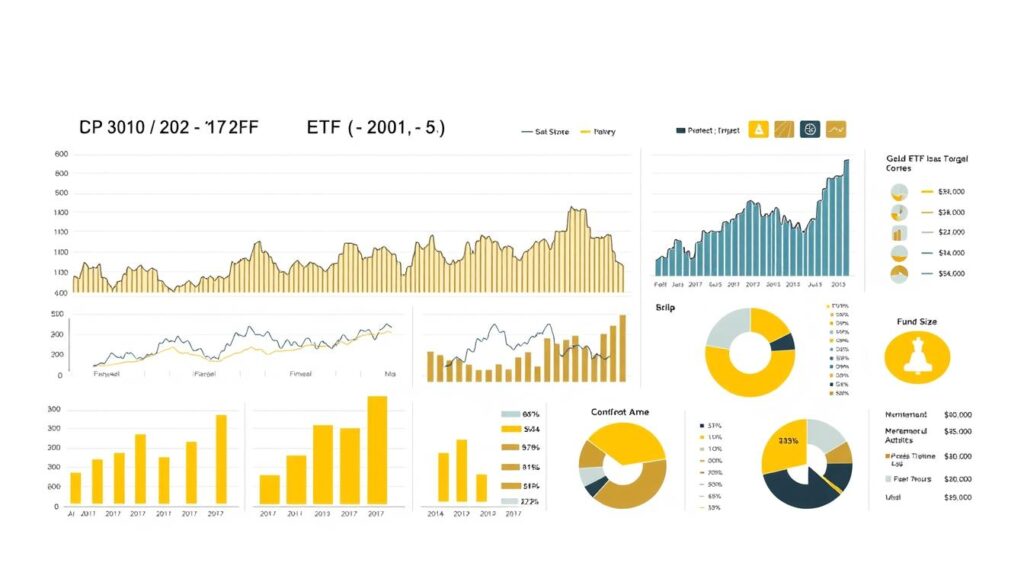

The global market for these investment vehicles has surged to $176 billion in assets. During the first half of 2025, they delivered a notable 17.12% return in EUR terms. This growth reflects rising demand for alternatives to stocks and bonds during economic uncertainty.

These funds combine liquidity with transparency, allowing seamless trading on major exchanges. Annual costs remain competitive, with expense ratios ranging from 0.11% to 0.69% across 18 available products. Such features make them appealing for both individual and institutional portfolios.

Historical data reveals their enduring role in wealth preservation. Unlike traditional assets, precious metals often move independently of market cycles. This characteristic strengthens diversification strategies while mitigating risk.

This guide explores how to evaluate different options, analyze performance trends, and align choices with financial goals. Understanding fee structures and regulatory safeguards proves critical for informed decision-making in this dynamic sector.

Introducing Gold ETFs and Their Unique Appeal

From ancient trade routes to digital markets, scarce resources have anchored financial stability. Modern investment tools now blend this historical reliability with cutting-edge accessibility. Physical holdings once required vaults and armored trucks – today’s solutions streamline exposure through regulated securities.

The Timeless Anchor in Wealth Preservation

Civilizations have prized rare metals for their ability to withstand political shifts and economic crashes. Unlike paper currencies or corporate debt, these commodities carry no counterparty risk. They often gain value when traditional assets falter, acting as financial shock absorbers.

Revolutionizing Access Through Innovation

Exchange-traded products dismantled barriers like storage fees and purity verification. Investors now track prices through instruments backed by bullion in high-security facilities. Tax considerations remain unique – long-term gains face higher rates than stocks, reflecting their special classification.

These vehicles combine the liquidity of shares with the tangibility of hard assets. Retail traders can allocate smaller amounts while institutions benefit from precise pricing. Market turbulence often increases demand, proving their role in balanced portfolios.

Gold ETF Options for UK Investors

UK markets offer specialized solutions for precious metal exposure, shaped by unique regulatory frameworks. European rules require diversification in UCITS-compliant funds, making Exchange-Traded Commodities (ETCs) the primary vehicle. These debt instruments mirror prices while holding physical bars in vaults, combining accessibility with tangible asset backing.

Physical Gold vs. Gold ETCs: What Sets Them Apart

Owning physical bullion demands secure storage and insurance. ETCs eliminate these hurdles through institutional-grade vaulting. Investors trade shares representing allocated metal, often in 12.5kg bars that reduce handling costs.

Three dominant products lead the market:

- iShares Physical Gold ETC (₤21.5B AUM)

- Invesco Physical Gold A (₤19.6B AUM)

- Amundi Physical Gold ETC (₤7.1B AUM)

Currency-hedged versions protect against GBP-USD swings. Unhedged options suit those seeking pure price movements. The choice hinges on whether investors prioritize cost efficiency or volatility management.

ETCs typically show tighter bid-ask spreads than retail bullion markets. Their structure allows real-time pricing through major exchanges, unlike physical purchases requiring dealer negotiations. This liquidity makes rebalancing portfolios simpler during market shifts.

Examining Costs, Fees, and Trading Dynamics

Smart investors know every basis point matters when building wealth over time. Understanding expense structures separates successful strategies from underperforming ones. Three critical factors shape total ownership costs: management fees, transaction spreads, and trading frequency.

Understanding Total Expense Ratio and Associated Fees

The total expense ratio combines annual charges for storage, insurance, and administration. Top-tier products maintain ratios below 0.15%, while others exceed 0.60%. Xtrackers leads with 0.11% fees, followed by Amundi and Invesco at 0.12%.

Key considerations include:

- Storage costs for physical assets

- Regulatory compliance expenses

- Currency conversion fees

Navigating Bid-Ask Spreads and Trading Costs

Market liquidity determines how much investors lose between buy-sell prices. SPDR’s 0.007% spread outperforms competitors by 50-300%. Larger funds typically offer tighter spreads due to higher trading volumes.

Frequent traders should prioritize:

- Real-time pricing transparency

- Exchange liquidity rankings

- Market maker participation levels

Long-term holders benefit more from low annual fees, while active traders need tight spreads. Balancing these factors optimizes returns across investment horizons.

Comparative Performance: Fund Size, Returns, and Market Trends

Market dynamics in 2025 highlight striking differences in how investment products capture value. Currency strategies and operational scale now dictate success rates across funds. Investors weighing options must consider both short-term price movements and long-term structural advantages.

Analyzing Rankings by Fund Return and Size

Xtrackers’ EUR-hedged product led 2025 returns at 36.43%, outpacing unhedged competitors by 4-11%. The best-performing funds shared three traits: currency protection, low fees, and billion-pound asset bases. iShares’ GBP-hedged ETC delivered 35.43% gains, proving size enhances liquidity without sacrificing returns.

Larger funds like Invesco’s ₤19.6B vehicle show tighter bid-ask spreads. This reduces trading costs for frequent rebalancing. Smaller products struggle with operational efficiency, often charging 0.60%+ in annual fees versus 0.12% for market leaders.

Sterling-hedged options outperformed unhedged versions by 8% last year. This gap reflects the dollar’s volatility against GBP. Investors prioritizing stability lean toward hedged products, while speculative traders favor unhedged exposure.

When markets dipped in Q2 2025, these funds rose 12% as the S&P 500 fell 6%. This inverse relationship strengthens their role in diversification strategies. Funds tracking physical holdings also outpaced synthetic alternatives by 3-5% annually.

Final Insights: Making Informed Investment Decisions in Gold ETFs

Choosing the right precious metals vehicle demands balancing cost efficiency with strategic objectives. Physical-backed products eliminate counterparty risks while offering direct exposure to bullion markets. With 18 distinct options available, investors must prioritize factors beyond expense ratios alone.

Currency-hedged versions prove vital for UK portfolios sensitive to GBP-EUR fluctuations. Larger funds typically combine tighter bid-ask spreads with robust liquidity, critical for frequent rebalancing. Reputable providers like iShares and Invesco deliver transparent tracking through institutional-grade vault storage.

Regular portfolio reviews ensure allocations align with shifting market correlations. While these commodities often offset equity downturns, they work best as part of diversified strategies rather than standalone bets. Position sizing remains key – most advisors recommend capping exposure at 5-15% of total assets.

The evolving landscape continues introducing innovative solutions for modern investors. As regulatory frameworks strengthen, these exchange-traded instruments solidify their role in wealth preservation strategies across market cycles.