Exness Review 2026: Trading Conditions, Fees and Account Types Explained

Choosing a reliable partner is crucial in the world of online trading. This broker has earned a strong reputation for trust and scale over many years.

Founded in 2008, the company has grown into one of the largest forex brokers globally by volume. The firm now serves over a million active clients worldwide.

Its operations span more than 13 international offices. This global reach supports a massive annual trading volume of trillions of dollars. The broker’s ranking has consistently improved in recent years.

This detailed analysis looks at what traders can expect. It breaks down the core trading conditions, including execution and leverage. A clear fee structure and available account types are also explained.

From Standard to professional Raw accounts, options exist for all experience levels. The platform offerings, from MetaTrader to proprietary terminals, cater to different needs. Understanding these details helps anyone make a more informed decision.

Overview of Exness and Its Market Presence

Operating across continents, the company has established a formidable presence in the trading industry. Its journey began in 2008.

This longevity is matched by a physical footprint spanning more than 13 international offices. This network supports a vast client base of over one million active users worldwide.

Company History and Global Reach

The firm’s growth mirrors the expansion of the online trading market. From a single entity, it has evolved into one of the largest volume brokers.

Its services are particularly strong in Asia, the Middle East, and Latin America. Localized support in these regions has built substantial brand recognition.

Regulatory Overview and Licensing

A robust regulatory framework underpins its operations. The broker holds licenses from several respected authorities globally.

Key Tier-1 regulators include the UK’s Financial Conduct Authority (FCA) and Cyprus’s CySEC. These provide a high level of trust and oversight for eligible clients.

Exness is also a member of The Financial Commission. This offers an extra dispute resolution layer with protection up to €20,000 per individual.

It is important for users to know which specific entity holds their account. Retail clients from the UK and EU are typically onboarded under other licensed entities.

In-Depth exness review of Broker Offerings

A broker’s product portfolio directly influences a trading strategy. Exness provides access to about 209 financial symbols across several key markets.

The selection includes 96 currency pairs. This covers all major, minor, and exotic forex options. Traders also get 10 global indices, like the S&P 500.

Commodities and cryptocurrencies are available as CFDs. This means you trade contracts, not the physical asset. Over 90 stock CFDs are offered, but there is no direct share ownership.

The platform does not list bonds or ETFs. Its focused range helps maintain sharp pricing. A Standard account starts at $10, while a Professional account requires $1,000.

Trading Conditions and Execution Quality

Traders evaluate a platform not just by its assets, but by the quality of order execution and available leverage. The broker’s trading conditions are designed to support diverse strategies.

Unlimited leverage is available on specific account types. This powerful tool requires careful risk management.

Instant and Market Execution Explained

Exness employs two distinct execution methods. Instant execution operates as a market maker model.

Market execution routes orders directly to liquidity providers. The Pro account uniquely allows switching between both styles.

Order Types and Risk Management Features

Traders can use market, limit, and stop orders. Customizable stop-loss and take-profit orders are essential tools.

Margin calls trigger at 30% equity for most professional accounts. Zero Spread and Raw accounts have no stop-out restrictions.

This setup demands vigilant monitoring of your trading positions. Effective use of these features defines successful trading conditions.

Account Types and Their Unique Features

The foundation of a successful trading journey begins with selecting the appropriate account type. This broker structures its offerings into two main categories to serve different needs.

Standard vs. Professional Accounts

Standard account types require a $100 minimum deposit. They offer unlimited leverage with spreads starting from 0.2 pips.

The Standard Cent variant uses cent lot units. This allows smaller position sizes for practice with real funds.

Professional account types demand a $1,000 minimum. They provide much tighter spreads and superior trading conditions.

The Pro account features 0.1 pip spreads with no commission. Zero Spread accounts show 0.0 pips on major instruments for a small fee.

Raw Spread accounts also start at 0.0 pips. They have a fixed commission structure ideal for active traders.

Social Copy Trading Account Options

Social account types create a community-driven ecosystem. Two specific variants are available: Social Standard and Social Pro.

A $500 minimum lets users copy experienced strategy providers. To become a provider oneself requires a $2,000 deposit.

This diversity of account types ensures solutions for beginners and experts alike. Each category addresses specific capital and strategy requirements.

Competitive Trading Fees and Commission Structures

Fee structures directly impact profitability, making their analysis essential before committing funds. This broker maintains a very low barrier to entry. A minimum deposit of just $10 makes the trading environment accessible to many.

Several account types feature commission-free pricing. The Standard, Standard Cent, and Pro accounts bundle all costs into the spread. This simplifies calculations for traders who value predictability.

For those seeking ultra-tight pricing, Zero Spread and Raw Spread accounts are available. They charge a commission of $3.50 per trade side. This model often results in lower total costs on major pairs.

Exness also runs a Premier Program for its most active clients. It has three tiers: Preferred, Elite, and Signature. Each requires significant lifetime deposits and quarterly trading volume.

Benefits include priority support and exclusive educational content. The program focuses on service and lifestyle perks rather than direct trading cost reductions. This is a key distinction from some competitor loyalty schemes.

Spread Analysis and Cost Efficiency

Analyzing spreads provides a clear window into a broker’s pricing competitiveness. For active participants, this spread analysis is the cornerstone of true cost efficiency.

Different account types cater to different needs. Standard Cent accounts have spreads starting from 0.3 pips. This is ideal for practice with small capital.

Standard accounts improve this with spreads from 0.2 pips. The Pro account offers even tighter pricing at 0.1 pips with no commission.

Zero Spread and Raw Account Comparisons

For maximum cost control, professional accounts are key. The zero spread account eliminates the spread cost on 30 major instruments.

It charges a small commission starting at $0.05 per lot. The Raw Spread account also offers spreads from 0.0 pips.

Its commission is higher, up to $3.50 per side. The choice depends on your trading style and volume.

- Zero Spread: Best for those who want predictable, near-zero spreads on majors.

- Raw Spread: Ideal for high-volume scalpers needing the absolute tightest pricing.

- Cost Calculation: Always combine the spread and commission to find your total cost.

Upgrading to a professional account can significantly reduce costs for serious forex traders. This makes spread analysis a vital step in strategy planning.

Platform Offerings: MetaTrader, Exness Terminal, and More

In today’s market, a powerful and intuitive trading platform is no longer a luxury but a necessity. Traders have access to a comprehensive suite of software options. This includes industry-standard MetaTrader platforms and a proprietary web terminal.

Comprehensive MetaTrader Suite Options

MetaTrader 4 and MetaTrader 5 are available as standard choices. These platforms deliver the trusted experience millions rely on worldwide. They fully support automated trading through Expert Advisors and custom indicators.

The extensive MQL programming community provides countless resources. This makes the MetaTrader suite ideal for both manual and algorithmic strategies. Traders appreciate the consistency and depth of these tools.

Innovative Features in the Exness Terminal

The proprietary Exness Terminal web platform features a clean, minimalist design. Its drag-to-modify order function is a standout useful feature. Traders can visually adjust stop-loss and take-profit levels with a simple mouse drag.

Charts are powered by TradingView, offering over 100 technical indicators. Nearly as many drawing tools are available for detailed analysis. The platform also integrates Trading Central signals directly into charts.

An economic calendar shows high-impact events as clickable country flags. The One Click Trading and Close All buttons enhance execution speed. These useful features help manage risk during fast market moves.

Free demo accounts with $10,000 in virtual funds let users test everything risk-free. Qualifying clients can access a free VPS server for uninterrupted automated trading. This trading platform combination ensures flexibility for all trader types.

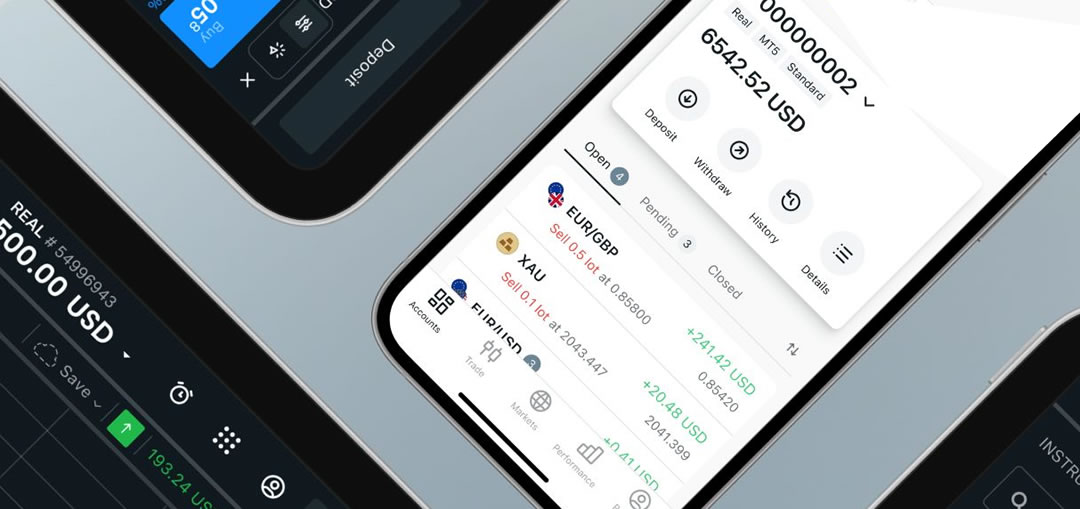

Mobile Trading and App Usability

The ability to manage positions from anywhere has become a cornerstone of modern trading strategies. A broker’s mobile offering is now a critical test of its commitment to user convenience.

Exness Trade App Performance

The Exness Trade app delivers a comprehensive mobile experience. Available on iOS and Android, it closely mirrors the web platform for a consistent feel.

Key features include integrated Trading Central signals in the watchlist. The intuitive drag-to-adjust function for stop-loss levels works perfectly on touchscreens.

Traders get news from FXStreet and predefined screeners like “Top Movers.” The charting tools offer 35 indicators for analysis on the go.

MetaTrader 4 and MT5 mobile apps are also available. They provide a familiar alternative for users of those platforms.

Insights on the Social Trading App

A dedicated Social Trading app supports copy trading accounts. It is currently available for Android devices on the Google Play Store.

This specialized trading app focuses on community-driven features. It allows users to follow and copy strategies directly from their phones.

While functional, its availability is more limited than the main trading app. This could restrict access for some traders interested in social trading.

Customer Support and Service Quality

Multilingual assistance and extended availability hours demonstrate a broker’s dedication to serving a global clientele effectively. For traders navigating complex markets, reliable customer support is not just a convenience but a necessity.

The firm provides support in numerous languages including Thai, English, and Chinese. Thai-speaking customers receive dedicated help six days a week.

Weekday hours run from 6:00 AM to 6:00 PM. Weekend assistance is available from 10:00 AM to 6:00 PM. This schedule covers both Asian and European trading sessions effectively.

Clients can reach out via live chat, email, or phone. Exness offers priority customer support to members of its Premier Program. This includes Preferred, Elite, and Signature tier clients.

User feedback presents a mixed experience. Many praise the responsiveness of support agents. Others report longer resolution times for complex withdrawal or verification issues.

For unresolved disputes, membership in The Financial Commission provides an important escalation path. This offers traders independent arbitration when direct communication fails.

Educational Resources and Research Tools

A robust collection of tutorials, analysis, and market insights empowers traders to develop confidence and refine their methodologies. The broker has made significant improvements to its learning materials.

These resources focus on practical application over generic theory. They provide immediate value for skill development.

Insights Portal and Trading Talks

The Insights portal is a central hub for actionable knowledge. Articles feature first-hand demonstrations of charting tools and specific strategies.

This makes the content highly practical for real-world trading. The Trading Talks podcast blends research with educational themes.

It offers high-quality audio discussions perfect for learning on the go.

Team Pro Contributions and Analysis Videos

Team Pro consists of experienced traders who share their methods in an influencer-educator style. Their videos are published on the official YouTube channel.

Weekly market outlook videos provide regular commentary from in-house analysts. These videos deliver timely fundamental and technical analysis.

Third-party news and analysis are integrated via Trading Central and FXStreet feeds. This streams headlines directly into the trading platforms.

While valuable, the offering lacks structured courses. Some content carries promotional elements that users should note.

Active Trader Programs and Loyalty Perks

Loyalty perks designed for active traders focus on service enhancements and exclusive content rather than direct cost reductions. The Exness Premier Program exemplifies this approach with a three-tiered structure.

This initiative rewards high-volume clients who meet specific deposit and trading volume thresholds. The tiers are Preferred, Elite, and Signature.

Each level requires progressively higher commitments:

- Preferred: $20,000 lifetime deposits and $50 million quarterly volume.

- Elite: $50,000 deposits and $100 million volume.

- Signature: $100,000 deposits and $200 million volume.

All members receive priority customer support and exclusive educational materials. They also get advanced trading analytics and special promotions.

Higher tiers add lifestyle benefits like event access. These perks cater to networking and experience.

A key point for cost-conscious traders is the program’s design. Unlike many competitor schemes, it offers no discounts on spreads or commissions.

The value lies in service and ancillary benefits. For an active trader, faster support can be crucial. The program recognizes substantial commitment to an account.

This broker‘s loyalty model suits those who prioritize support and exclusive access over direct fee reductions.

Security, Trust Score, and Regulatory Compliance

Understanding the regulatory framework and trust score helps clients assess the security of their money. This evaluation is crucial for anyone entrusting capital to a trading platform.

Trust Score Evaluation

The broker holds a Trust Score of 80 out of 99. This places it firmly in the “Trusted” category.

It reflects a strong operational track record and regulatory compliance. Such a score should provide reasonable confidence to traders.

Overview of Global Regulatory Measures

Exness is authorized by two Tier-1 regulators: the UK’s FCA and Cyprus’s CySEC. These are among the world’s most demanding authorities.

However, an important caveat exists. The UK and Cyprus entities do not accept retail clients. Most individual traders are onboarded to entities under less strict jurisdictions.

The broker also holds Tier-2 and Tier-4 licenses in other countries. This allows it to serve clients from numerous regions.

Protection levels vary based on which entity holds the account. Membership in The Financial Commission adds a layer of protection.

It offers compensation up to 20,000 euros for unresolved disputes. This provides an independent arbitration pathway.

Security measures include segregated client funds at major banks. Secure SSL encryption and multi-factor authentication protect trader money and personal information.

Traders should verify which specific entity holds their account. Understanding the relevant regulatory safeguards is essential for safety in each country they operate.

Promotional Offers and Community Engagement

Beyond daily operations, a company’s involvement in industry events and social causes shapes its public identity. This perspective reveals values that transcend profit maximization.

The broker earned the “Most Client-Oriented Broker 2025” award at Forex Expo Dubai. This major event gathers professionals from across the fintech world.

Recognition here signals a strong commitment to serving traders. It also hosted its own Exness Connect conference in Malaysia.

Over 550 team members and partners attended for networking and news on market trends. Community efforts focus on three key areas.

These are Education, Environment, and Emergency relief. Initiatives include scholarships, tree-planting projects, and global disaster support.

However, the firm runs fewer deposit bonuses or cashback promotions than some rivals. Traders seeking immediate financial incentives may note this difference.

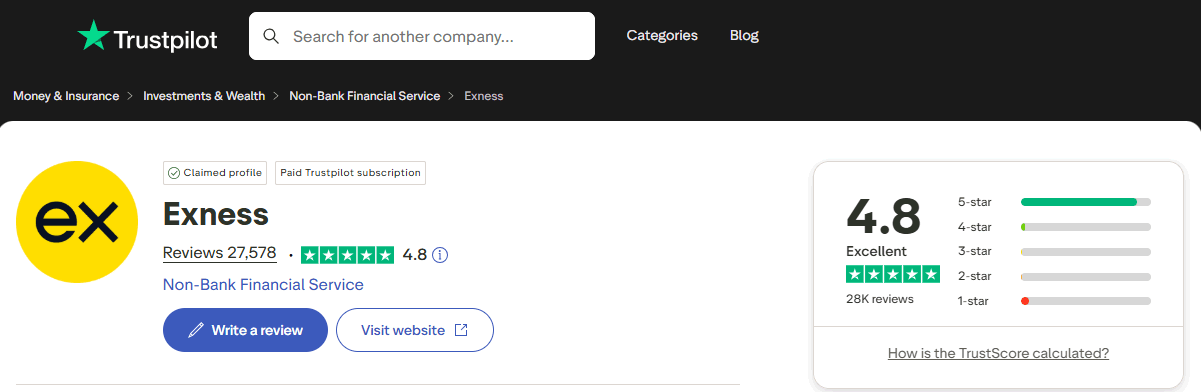

Real User Feedback and Trustpilot Reviews

Trustpilot reviews paint a detailed picture of day-to-day trader experience with this platform. The feedback reveals highly polarized experiences.

Positive Experiences Highlighted

Many users praise the platform‘s interface. They call it user-friendly and easy for beginners to navigate.

Fast withdrawals are a consistent theme in positive feedback. Traders from Thailand and other regions report funds arriving quickly.

The zero spread account receives particular praise. Cost-conscious users describe it as a key advantage for their trading exness strategies.

Commission-free standard accounts also get positive mentions. They are appreciated by those starting with smaller balances.

Critical Reviews and Resolution Timelines

However, a significant number of reports detail serious problems. Some users face withdrawals delayed over 15 days despite full verification.

One detailed complaint involved a trader claiming substantial losses. He provided video evidence of a frozen platform during high volatility.

Such disputes sometimes escalate to third-party arbitration. Case #16018 with the Financial Commission is one noted example.

This pattern suggests most routine operations are smooth. Complex issues, however, can lead to a frustrating experience requiring persistent follow-up.

Exness in the Competitive Forex Market

Exness has demonstrated notable progress in recent years, moving up significantly in authoritative rankings. ForexBrokers.com ranked it #31 overall in 2026, improving from #51 in 2024. The broker scored 4.0 and received awards, showing consistent historical improvement.

The forex market is intensely competitive, with hundreds of brokers vying for attention. Among the best forex brokers, this firm distinguishes itself through ultra-competitive spreads and unlimited leverage. Rapid withdrawal processing is another critical advantage for traders.

Selecting the best broker requires evaluating multiple dimensions. These include regulatory protection, trading costs, and platform quality. Best trading conditions vary by individual needs.

Scalpers prioritize raw spreads, while beginners seek educational resources. The forex industry’s high-risk nature means traders can lose money rapidly due to leverage. Reliability during volatile market conditions becomes equally critical.

This broker has captured substantial share in Asian and Latin American markets. For those seeking the best forex broker, it merits consideration for its pricing and flexibility. Traders must always remember they can lose money and should manage risk carefully.

Final Thoughts on Exness’s Offerings and Future Outlook

Final assessment reveals a broker with distinct strengths in pricing and execution. Its ultra-competitive spreads and rapid withdrawals build strong confidence.

The platform is easy to use, with innovative features. Educational efforts through the Insights portal add real value, as experts note.

However, the limited range of tradable instruments is a gap. Retail clients are onboarded to entities in less strict regulatory conditions.

For traders outside the U.S., U.K., and EU, it is a viable option for forex trading. Testing with a demo account is wise to verify quality.

Always remember that leverage can amplify losses. Proper risk management is essential to avoid losing money.