IC Markets cTrader Web Platform for Forex Trading

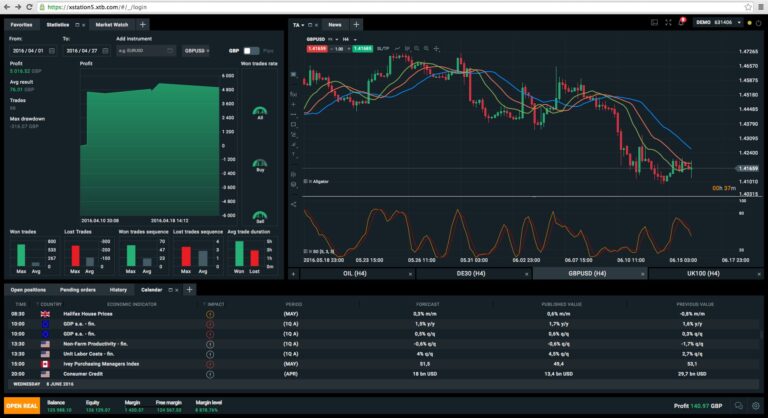

Modern traders require tools that combine flexibility with professional-grade features. The browser-based cTrader platform delivers exactly that, offering seamless access to global markets without downloads. Compatible with Chrome, Firefox, Safari, and IE 9+, it works instantly on most devices.

Traders enjoy raw spreads and unrestricted order types, ideal for strategies ranging from micro-lot positions to large-volume trades. With minimum trade sizes starting at 0.01 lots and no upper limits, the system accommodates both cautious entries and aggressive scaling.

Full market depth visibility through Level II pricing reveals real-time supply and demand dynamics. This transparency helps users identify trends and execute trades with confidence. Advanced charting tools built into the interface support technical analysis without requiring external software.

One-click execution speeds meet fast-paced market conditions, while multiple order types ensure precise trade management. Real-time reporting keeps traders informed, and leverage up to 1:500 allows strategic risk-taking. These features combine to create a versatile environment for diverse trading approaches.

Overview of IC Markets cTrader Web Platform

Bridging the gap between retail and institutional trading requires adaptable technology. The global cTrader platform achieves this by offering real-time forex and CFD access with low latency and transparent pricing. Traders gain a competitive edge through infrastructure hosted in the LD5 IBX Equinix Data Center, ensuring rapid execution even during volatile sessions.

Comprehensive Forex Trading Solution

This user-friendly platform supports micro-lot positions starting at 0.01 lots, removing barriers for small-scale traders. Full market depth visibility through Level II pricing allows precise analysis of supply-demand dynamics. Key advantages include:

- Competitive commissions paired with raw spreads

- Multiple order types for strategic flexibility

- Real-time reporting for informed decision-making

Innovative and Versatile Platform

Advanced features like detachable charts and customizable interfaces cater to diverse strategies. One-click trading accelerates execution, while expanded symbol displays simplify asset selection. Funding and withdrawal options adapt to regional preferences, particularly for Vietnamese traders requiring localized payment methods.

The system’s ultra-low latency connectivity minimizes slippage, critical for scalping or high-frequency approaches. Combined with unrestricted position sizing, it creates an environment where both cautious and aggressive strategies thrive.

Advanced Trading Features and Tools

Successful trading demands precision and adaptability. Modern platforms must deliver robust solutions that evolve with market complexity. This section explores professional-grade features designed to sharpen decision-making and execution efficiency.

Advanced Charting and Technical Analysis

Traders gain an analytical edge through customizable chart layouts supporting 50+ indicators. Detachable windows enable multi-screen setups, allowing simultaneous analysis of EUR/USD trends and GBP/JPY patterns. Real-time sentiment indicators reveal crowd psychology, while 21 timeframe options cater to scalpers and long-term strategists alike.

The system’s depth of market display exposes liquidity clusters, helping identify support zones before major news events. Drawing tools and price alerts simplify pattern recognition, turning raw data into actionable insights.

Fast and Precise Order Execution

Order execution capabilities shine during volatility, processing trades in under 0.15 seconds. Reduced latency minimizes slippage when entering gold positions during Fed announcements. Conditional orders automate entries based on moving average crossovers or RSI thresholds.

Smart stop-out protocols safeguard accounts by liquidating positions at predefined equity levels. Combined with tiered take-profit targets, these trading tools help lock in profits during unexpected reversals. Level II pricing transparency ensures traders see the full order book before committing capital.

ic markets ctrader web: A Closer Look

Global traders need solutions that adapt to dynamic conditions while maintaining precision. The browser-based platform combines accessibility with professional tools, letting users engage markets from anywhere in the world without installations. Real-time analytics and adaptive risk controls create an environment where strategy meets opportunity.

Seamless Trading Experience

Instant access via Chrome or Safari removes technical barriers. Traders analyze EUR/USD trends during Tokyo sessions or gold prices in London hours through expanded symbol displays. One-click execution captures fleeting opportunities, while detachable charts enable multi-asset monitoring.

Real-time reports track performance metrics like drawdown percentages and win rates. This transparency helps Vietnamese traders refine strategies using localized payment methods. No restrictions on limit orders allow scalping during volatile news events or position holds across time zones.

Smart Tools for Active Traders

Dynamic smart stop-loss mechanisms adjust to volatility, locking profits during sudden reversals. The system’s depth of market display reveals hidden liquidity zones, crucial before central bank announcements. Key advantages include:

- Automated risk controls that preserve capital during gaps

- Level II pricing for accurate entry/exit decisions

- Custom alerts for breakout patterns or RSI thresholds

These tools empower traders to manage positions from anywhere in the world, balancing aggression with discipline. Combined with raw spread pricing, they transform complex data into actionable insights.

Navigating the User-Friendly cTrader Interface

Trading efficiency thrives when tools adapt to user needs rather than demanding adaptation. The platform’s user-friendly interface merges simplicity with precision, allowing traders to focus on strategy instead of software mechanics. Every element is designed for quick access, from chart customization to risk management controls.

Simple Navigation with Detachable Charts

Detachable windows transform workspace organization. Charts separate from the main screen let traders monitor EUR/JPY trends alongside crude oil prices simultaneously. Users resize panels or stack them vertically for multi-timeframe analysis without clutter.

The advanced interface supports 18 chart types and 50+ technical indicators. Timeframes adjust from one-minute ticks to monthly views, catering to scalpers and long-term investors alike. Live sentiment widgets reveal crowd behavior, while Level II data exposes hidden liquidity zones before major economic releases.

Key advantages include:

- Drag-and-drop functionality for instant layout changes

- One-click order modifications during volatile sessions

- Zero platform restrictions on trading styles or durations

Risk parameters integrate directly into chart windows. Traders set smart stop-loss orders by dragging lines across price levels, locking in profits during sudden reversals. This seamless design eliminates friction between analysis and execution, letting strategies unfold unimpeded.

Cutting-Edge System Requirements and Data Center Benefits

Robust infrastructure forms the backbone of effective trading systems. Modern platforms demand reliable connectivity paired with accessible technology. This combination ensures traders capitalize on opportunities without technical limitations.

Optimized Browser Support and System Performance

The platform operates seamlessly across Chrome, Firefox, Safari, and IE 9+. No specialized software installations are needed. Desktop users require minimal specs: dual-core processors and 2GB RAM ensure smooth operation on Windows 7 or newer systems.

IBX Equinix Data Centre for Reliable Connectivity

Hosted in the LD5 IBX Equinix data center, servers benefit from London’s financial hub proximity. This strategic location reduces latency during European sessions. Redundant power systems and climate controls maintain uptime during critical market events.

Ultra-low latency connections to liquidity providers minimize slippage. Traders experience execution speeds under 0.15 seconds even during high volatility. The global cTrader server network leverages Equinix’s infrastructure for consistent performance worldwide.

Flexible Trading Options with Level II Pricing

Real-time Level II data flows through high-speed connections. This ensures accurate pricing during news releases or rapid price shifts. Traders analyze order book depth to identify liquidity clusters before placing positions.

The IBX data centre architecture supports 24/7 market access. Combined with raw spread pricing, it creates an environment where scalpers and long-term strategists thrive. Risk management tools integrate seamlessly, balancing aggression with disciplined capital preservation.

Step-by-Step Guide to Opening an Account and Trying a Free Demo

Entering global financial markets begins with a straightforward account setup process. Traders can start trading within minutes while testing strategies risk-free through demo environments. This approach balances accessibility with professional-grade tools for all experience levels.

Simple Account Registration Process

Creating a global account involves six key steps:

- Complete the online form with basic personal details

- Submit identification documents for verification

- Download the trading terminal from the platform’s tools section

- Launch the software and select ‘Login to Trade Account’

- Enter credentials and connect to preferred servers

- Confirm successful login through the system’s audio alert

The try free demo option becomes available immediately after installation. Users practice with virtual funds mirroring live market conditions. This feature helps refine strategies using real-time charts and order types without financial risk.

Funding methods cater to Vietnamese preferences, including local bank transfers and e-wallets. Verified accounts gain full access to raw spreads and ultra-fast execution. Round-the-clock support assists with technical queries during Asia-Pacific trading hours or European sessions.

Elevating Your Trading Experience

Trading mastery evolves when technology aligns with ambition. The global cTrader platform provides tools to take trading next level, blending precision with adaptability. Whether analyzing EUR/USD trends or monitoring crude oil swings, users access real-time data across devices without installations.

This system transforms strategy execution through stop logic protocols and instant order modifications. Traders secure profits during volatility while testing approaches risk-free via demo modes. Compatibility with multiple operating systems ensures seamless transitions between desktop analysis and mobile adjustments.

Vietnamese users benefit from localized payment integrations and 24/7 regional support. The platform allowing enjoy raw spreads and Level II pricing turns complex data into clear opportunities. Scalpers capture micro-movements, while position traders leverage expanded timeframes for long-term plays.

Ready to start trading smarter? Explore how professional-grade tools can refine your edge in markets global in scope. From one-click execution to customizable alerts, every feature aims to elevate decision-making – wherever you engage anywhere world markets unfold.