IC Markets Global Uncovered: Tools, Accounts, and Market Access for Traders

For traders seeking seamless access to financial markets, one platform combines speed, diversity, and innovation. With lightning-fast execution and institutional-grade liquidity, it bridges retail and professional trading needs. Users gain exposure to indices, commodities, cryptocurrencies, and shares—all under one interface.

The service supports over 2,250 instruments, allowing strategies across asset classes. Tight spreads starting at 0.0 pips reduce costs for frequent traders. Advanced infrastructure handles volatility smoothly, ensuring orders fill accurately even during news events.

Flexibility defines this ecosystem. Whether testing manual techniques or deploying automated systems, the tools adapt. Vietnamese traders appreciate 24/5 market access, aligning with global hours without geographical limits. Local support and multilingual resources further enhance accessibility.

Transparency remains a priority. Competitive pricing models and clear fee structures help users manage risks effectively. By merging technology with trader-centric design, the platform empowers individuals to navigate markets confidently.

Overview of IC Markets Global Services

Effective trading hinges on access to diverse instruments and swift execution. The platform delivers 2,250+ assets, including forex pairs, commodities, and stock indices. Traders can start trading with competitive 0.0 pip spreads and adjustable leverage, balancing opportunity with risk control.

Three pillars define the service:

- Deep liquidity from top-tier providers

- Multi-asset portfolio building tools

- Real-time market data feeds

Superior liquidity ensures minimal slippage, even during high volatility. Educational webinars and strategy guides help users refine their approaches. Vietnamese traders benefit from localized account management and 24/5 access to worldwide opportunities.

The service bridges retail and institutional trading through:

- Professional-grade execution speeds

- Advanced technical analysis packages

- Secure cloud-based infrastructure

By offering premium products through intuitive interfaces, the platform empowers traders at all experience levels. Demo accounts let users try strategies before committing capital, reducing initial market entry barriers.

ic markets global Trading Platforms and Account Types

Tailored solutions empower traders to choose tools matching their goals. Flexible infrastructure supports everyone from first-time users to seasoned professionals, with options balancing accessibility and advanced functionality.

Multiple Account Options for Every Trader

Three distinct account types cater to varying needs. Beginners can try free demo versions to practice strategies risk-free. Active traders benefit from 0.01 micro-lot sizing for precise risk management.

The streamlined setup process involves:

- Completing a digital registration form

- Uploading verification documents

- Selecting preferred funding methods

- Executing the first trade

This four-step approach lets users open account profiles in under 10 minutes. Live account holders access real-time data feeds and institutional-grade execution speeds.

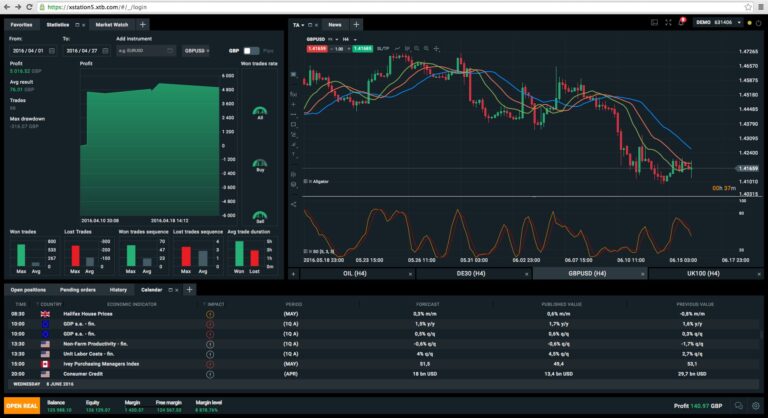

State-of-the-Art Trading Platforms

Cutting-edge software delivers professional tools through intuitive interfaces. Users start trading forex, commodities, or indices with one-click order execution and customizable dashboards.

Key platform features include:

- Advanced charting packages with 80+ indicators

- Automated strategy compatibility

- Multi-device synchronization

Demo environments mirror live market conditions, letting traders trading try free before committing capital. Real-time alerts and price action tools help identify opportunities across 2,250+ instruments.

Navigating Global Markets with Competitive Spreads

Competitive spreads form the backbone of cost-effective trading strategies. The platform delivers raw pricing models with spreads starting at 0.0 pips, allowing traders to minimize costs while accessing diverse assets. Transparent bid and ask structures reflect real-time liquidity, creating fair conditions for all participants.

Understanding Bid and Ask Prices

Every trade begins with two key numbers: the bid and ask. For example, a currency pair might show bid 1.16692 and ask 1.16692, indicating identical pricing with no spread gap. This tight alignment reduces entry barriers, letting traders execute orders near actual market values.

Such precision helps identify optimal entry points. When spreads remain near 0.0 pips, frequent traders preserve capital over multiple transactions. Real-time price feeds ensure quotes mirror genuine supply and demand shifts.

Raw Spread Advantages

Raw spread pricing removes hidden markups, connecting users directly to interbank rates. Unlike fixed spreads, these dynamic rates adjust with market volatility, offering fairer conditions during news events or liquidity surges.

Traders save significantly on high-volume strategies. A 0.0 pips spread on major pairs means lower costs per trade, amplifying potential returns. This model particularly benefits scalpers and algorithmic systems executing dozens of daily transactions.

Superior Order Execution and Low Latency Performance

In fast-paced financial markets, every millisecond counts. Traders need technology that keeps pace with rapid price movements while maintaining reliability. Advanced infrastructure ensures orders reach markets faster than competitors, turning split-second opportunities into tangible results.

Lightning-Fast Order Execution

Execution speeds under 1 millisecond give traders an edge in volatile conditions. The platform processes orders through strategically located servers in New York and other hubs. This setup reduces physical distance to liquidity providers, slashing delays.

Scalpers and algorithmic systems thrive with microsecond precision. Manual traders also benefit—no requotes or slippage during news events. Whether opening or closing positions, users experience near-instant trade confirmation.

Benefits of Low Latency Trading

Low latency technology minimizes the gap between decision and action. Tight spreads remain intact even when entering multiple trades daily. This efficiency helps strategies like arbitrage and high-frequency trading succeed.

Consistent performance during volatility protects profits. CFDs and other derivatives execute under the same strict standards, ensuring fairness. Traders can start trading try new approaches knowing the system handles pressure flawlessly.

Key advantages include:

- Reduced risk of missed opportunities

- Accurate price capture during market spikes

- Seamless integration with automated tools

Diverse Trading Instruments and CFD Offerings

Traders thrive when they can explore multiple opportunities simultaneously. A single platform now provides access to 2,250+ assets across major financial categories. This variety supports strategies ranging from short-term speculation to long-term portfolio growth.

Access to Forex, Indices, Commodities, and More

The wide range of instruments includes 60+ forex pairs. Major currencies like USD and EUR dominate, but exotic pairs offer niche opportunities. Traders can start trading during Asian, European, or American sessions, aligning with global market hours.

CFD products cover indices from the S&P 500 to Germany’s DAX. These contracts let users profit from market trends without owning physical assets. Energy commodities like crude oil and natural gas provide exposure to geopolitical shifts and economic cycles.

Key offerings include:

- Precious metals for inflation hedging

- Agricultural goods influenced by seasonal trends

- Cryptocurrencies with 24/7 volatility

Stock CFDs simplify access to companies like Apple or Tesla. Users trade price movements without high capital requirements. This flexibility makes CFD products ideal for adapting to fast-changing conditions.

The platform’s wide range eliminates the need for multiple accounts. Vietnamese traders manage forex, commodities, and indices through one interface. Real-time data feeds ensure informed decisions across all asset classes.

Seamless Account Funding and Secure Payment Methods

Efficient financial management begins with hassle-free transactions. Traders can fund trading account balances through multiple verified channels, ensuring quick access to global opportunities. The platform’s instant processing eliminates delays, letting users capitalize on market movements within minutes.

- Bank wire transfers for large transactions

- Credit/debit cards for instant processing

- E-wallets supporting regional preferences

Vietnamese traders benefit from localized options like MoMo and ZaloPay integration. Funds reflect immediately after verification, letting users start trading without interruptions. The open account process requires just four steps:

- Complete digital registration

- Verify identity documents

- Select preferred deposit method

- Transfer funds securely

Advanced encryption protects all transactions. Live account holders enjoy 24/5 support for deposit-related queries. Multi-currency support accommodates USD, VND, and EUR, reducing conversion fees for international users.

Withdrawal requests process within one business day, maintaining cash flow flexibility. Whether funding $100 or $10,000, the system ensures equal security standards. This reliability lets traders focus on strategies rather than transaction logistics.

Advanced Analytics and Real-Time Market Trends

Informed trading decisions require more than intuition—they demand precise data. The platform equips users with institutional-grade analytical tools, transforming raw numbers into actionable insights. Real-time updates and historical patterns merge to reveal hidden opportunities across assets.

Interpreting Market Volume and Trends

Volume indicators act as market truth-tellers. Sudden spikes often signal upcoming price shifts, while steady declines may indicate weakening trends. Traders can start trading try strategies using:

- Volume oscillators for momentum confirmation

- Sentiment analysis across social and news feeds

- Liquidity heatmaps for order concentration zones

Sophisticated charting packages include 80+ technical indicators. Customizable overlays help spot support/resistance levels or Fibonacci retracements. Vietnamese traders access these tools alongside localized economic calendars for regional event impacts.

Pricing analytics reveal bid-ask spread behaviors during Asian or European sessions. This helps optimize entry points for CFDs and forex pairs. Historical volatility metrics guide position sizing, balancing risk across multiple products.

Real-time alerts notify users of breakout patterns or unusual volume surges. Whether scalping indices or holding commodities, these tools help trade with precision. Data-driven decisions replace guesswork, creating consistent strategies for all market conditions.

Experience the Free Demo and Trial Trading Options

Before risking capital, perfect your approach with virtual trading environments mirroring real market conditions. These tools let users refine strategies using live price data and professional charting packages—all without financial exposure. Vietnamese traders gain 24/5 access to practice sessions matching regional market hours.

Try Free Demo to Test the Waters

The demo account provides $10,000 in virtual funds for unlimited experimentation. Users explore 2,250+ instruments while testing technical indicators or automated systems. Key features include:

- Real-time bid/ask spreads identical to live trading

- Full access to historical data and analysis tools

- Zero fees or subscription requirements

New traders build confidence through simulated wins and losses. Experienced users stress-test advanced strategies during volatile periods. All activity syncs across devices, letting you practice anywhere—ideal for Vietnam’s mobile-first population.

Transitioning to live accounts takes one click when ready. This risk-free sandbox bridges learning and execution, empowering smarter market decisions.