IC Markets Raw Spread vs Standard Explained – Account Types Comparison

Choosing the right brokerage account can significantly impact a trader’s costs and strategy. Two popular options cater to different needs: one prioritizes simplicity, while the other focuses on precision pricing. This guide breaks down their core differences to simplify decision-making.

The Standard account suits newcomers with its straightforward approach. It eliminates per-trade fees but incorporates costs into wider spreads. This setup allows beginners to focus on learning without complex calculations.

Seasoned investors often prefer the Raw Spread alternative, which offers razor-thin margins paired with transparent per-lot charges. This model mirrors institutional pricing structures, rewarding high-volume activity with lower overall expenses.

Understanding these fee models is crucial. While the commission-free option appears simpler, frequent traders might save more through tighter spreads despite nominal transaction fees. The choice ultimately depends on individual trading frequency, capital size, and strategy complexity.

Overview of IC Markets Trading Accounts

Selecting the optimal trading setup requires understanding account structures tailored to different strategies. Traders can choose between two primary account types, both offering access to over 1,980 financial instruments. These include forex pairs, commodities, indices, and global stocks through MetaTrader platforms.

Both account types share critical advantages. They provide identical execution speeds and platform tools, ensuring no compromise on trade quality. Regulatory safeguards protect client funds through segregation in top-tier international banks.

Flexibility remains a key feature. Users can operate multiple accounts simultaneously or switch between types as their experience grows. This adaptability helps traders refine their approach without restarting the verification process.

The absence of minimum deposit requirements lowers entry barriers for newcomers. Seasoned investors appreciate the ability to scale strategies efficiently across different account structures. By focusing on these shared benefits, traders can better evaluate each type’s unique fee models and pricing mechanisms.

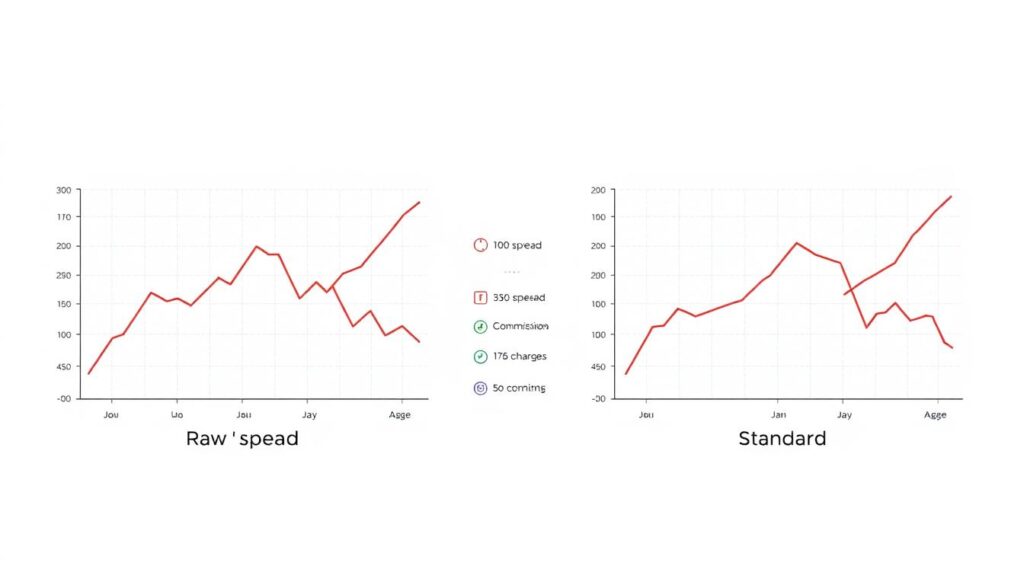

Understanding the ic markets raw spread vs standard

Traders face a critical decision when balancing cost structures and pricing models. The choice between account types determines visibility into expenses and potential profitability. One model offers unaltered pricing with separate fees, while the other bundles costs into wider bid-ask differences.

The Raw Spread account displays real-time prices from liquidity providers without markups. Each trade incurs a $7 commission per standard lot, making costs transparent and predictable. This setup suits active participants who prioritize precise expense tracking.

In contrast, the Standard account incorporates fees into slightly expanded spreads. A 0.8 pip markup replaces separate commissions, simplifying cost calculations for occasional traders. However, this approach may increase overall expenses for frequent transactions.

High-volume operators often favor the Raw Spread model. Tight pricing allows capturing small market movements, offsetting commission fees through volume. Casual users might prefer the Standard structure’s simplicity, accepting marginally higher per-trade costs for easier budgeting.

Key Differences in Trading Conditions and Fees

Effective cost management separates successful traders from the rest. Two distinct pricing models dictate how expenses accumulate during market activity. Understanding these systems helps optimize profitability across various strategies.

Transparency in Transaction Costs

The commission-based model charges fees per traded lot. Rates fluctuate based on the account’s base currency – from $7 USD to ¥1100 JPY per standard lot. MetaTrader platforms display these costs differently: MT4 shows combined fees, while MT5 splits them between entry and exit.

Alternatively, the spread-focused approach absorbs costs within price gaps. This method adds 0.6-0.8 pips to interbank rates, eliminating separate charges. Though simpler for beginners, frequent traders might pay more through widened margins.

Calculating Real Trading Expenses

Forex pairs demonstrate the cost contrast clearly. A EUR/USD position shows 0.1 pip spreads plus $7 commission in one account type. The alternative displays 1.3 pip spreads with zero fees. High-frequency strategies benefit from tighter pricing, while casual users prefer predictable costs.

CFD trading follows similar principles. Equity indices and commodities maintain consistent fee structures within each account. Active traders should compare total expenses across 100+ trades to identify savings potential.

Volume discounts don’t apply, making precise calculations essential. Micro-lot traders pay proportionally smaller fees – $0.035 per 0.01 lots. This granularity helps newcomers test strategies without significant risk.

Deep Dive Into the Raw Spread Account

Trading efficiency often hinges on accessing unfiltered market conditions. This account type removes intermediaries, connecting users directly to liquidity providers. Traders see real-time prices without artificial adjustments, creating a level playing field.

Low Commission and Tight ECN Spreads

The structure charges $3.50 per $100,000 traded – half the industry average. Major currency pairs maintain gaps as low as 0.1 pips, while gold trades near 1-pip margins. These razor-thin differences stem from Electronic Communication Networks aggregating prices from 50+ global banks.

Cost calculations become straightforward. Each transaction displays separate fees, eliminating guesswork. This transparency helps traders measure exact break-even points before executing strategies.

Benefits for High Volume Traders

Frequent operators save substantially through compressed spreads. A day trader making 50 EUR/USD trades would pay $175 in commissions but save 600 pips in spread costs. This math favors active participants using scalping or algorithmic approaches.

The model particularly shines during volatile periods. Tight pricing allows capturing micro-movements that wider spreads would negate. Professional users also value the absence of requotes, ensuring lightning-fast order execution.

Exploring the Standard Account Features

Navigating financial markets becomes less daunting with account structures designed for clarity. The commission-free model simplifies cost management by embedding fees directly into pricing. This approach removes complex calculations, letting users focus on strategy development rather than expense tracking.

No Commission, Marked-Up Spreads

This account type adds a 0.8 pip adjustment to interbank rates instead of charging separate fees. Currency pairs like EUR/USD display slightly wider gaps, but all costs remain visible upfront. Traders avoid surprise deductions from their balance since expenses are already factored into execution prices.

The structure proves ideal for those prioritizing simplicity. Newcomers can easily calculate potential profits by focusing solely on spread differences. There’s no need to juggle multiple fee components during fast-moving market conditions.

Ease of Use for Beginners

First-time users appreciate the straightforward approach to cost management. Learning essential skills becomes easier without commission-related math distracting from market analysis. The all-inclusive pricing model reduces psychological pressure during initial trades.

Developing a trading experience feels more natural when focusing on chart patterns rather than fee optimization. Many find this setup less intimidating when they start trading, allowing gradual skill development. Clear cost visibility helps build confidence during early decision-making stages.

Trading Platform and Execution Speed

Modern traders demand robust tools that match their technical requirements. Both account types deliver identical access to industry-leading MetaTrader 4 and 5 platforms. These systems combine professional-grade capabilities with intuitive interfaces for all experience levels.

The platforms’ execution architecture ensures lightning-fast trade processing across all account variants. Orders reach liquidity providers in under 1 millisecond, maintaining parity between users. This technological edge helps traders capitalize on fleeting market opportunities without delays.

MetaTrader 4 & 5 Advantages

Three core strengths define these trading platforms:

- Customizable charts with 80+ technical indicators

- Automated strategy execution through Expert Advisors

- Multi-device synchronization across desktop and mobile

Advanced order management tools function identically across account types. Traders set stop-loss limits, trailing stops, and take-profit levels with equal precision. Real-time price alerts keep users informed during volatile sessions.

Execution reliability remains uncompromised regardless of chosen fee structure. The broker’s infrastructure processes 500,000+ trades daily with 99.98% uptime. This consistency allows scalpers and position traders alike to operate with confidence.

Platform customization options adapt to individual strategies. Users create personalized workspaces with saved templates and custom indicators. These features ensure seamless transitions between different trading approaches within the same account.

Benefits for Forex and CFD Traders

Diverse trading opportunities empower investors to capitalize on global market movements. Access to multiple asset classes enables strategic flexibility across economic cycles. This variety helps traders adapt to shifting conditions while maintaining portfolio balance.

Wide Range of Currency Pairs and Assets

Over 75 currency pairs cater to every strategy style. Major pairs like EUR/USD and GBP/USD appeal to risk-averse participants, while exotic combinations attract those seeking volatility. Cryptocurrency CFDs bridge traditional and digital markets for modern traders.

Commodities and indices round out the offerings. Gold, silver, and oil CFDs provide inflation-hedging tools. Global stock indices let traders speculate on entire economies without individual equity risks.

The platform simplifies exposure to 1,980+ instruments. Users switch between forex positions and commodity trades in seconds. This fluidity helps capture emerging trends across markets efficiently.

Portfolio diversification becomes effortless with multi-asset access. A single account handles currency speculation and equity index hedging simultaneously. Such versatility supports sophisticated risk management strategies for all experience levels.

Role of Liquidity Providers in Order Execution

Market dynamics depend heavily on unseen forces that shape pricing and trade execution. Behind every transaction lies a network of institutions competing to offer the best rates. These key players determine how smoothly trades flow through financial systems.

ECN and STP Explained

Electronic Communication Networks (ECN) act as digital marketplaces. They connect traders directly with banks and financial institutions. This setup removes middlemen, letting participants interact like institutional players.

Straight Through Processing (STP) ensures trades reach liquidity providers instantly. No human intervention or dealing desk alters prices during execution. Orders fill at rates reflecting real-time supply and demand.

Three advantages define this approach:

- Pricing from 50+ global banks creates tighter spreads

- Zero conflict of interest between brokers and traders

- Consistent execution during news events or volatility

Multiple liquidity providers compete for order flow. This competition drives spreads lower than single-source models. Traders benefit whether scalping micro-movements or holding positions for weeks.

The system’s transparency builds trust. Users see genuine market depth instead of artificial quotes. Combined with STP technology, it creates a fair environment for all account types.

Flexibility in Leverage and Trading Conditions

Adaptable leverage settings empower traders to navigate diverse market scenarios. Both account types permit adjustments from conservative 1:1 ratios to aggressive 1:500 levels. This range accommodates cautious newcomers and capital-efficient professionals alike.

Traders modify exposure through their Client Area in real time. A single click adjusts risk parameters as strategies evolve or volatility shifts. This feature proves vital when managing open positions during earnings reports or geopolitical events.

Multiple accounts enable tailored risk approaches. Users maintain separate profiles for scalping strategies and long-term trades simultaneously. Each account can operate at different leverage levels, creating distinct risk environments under one login.

Position sizing adapts to all experience tiers. Micro-lot traders test strategies with minimal capital, while institutions execute large orders efficiently. The system scales seamlessly, handling transactions from $1 to multi-million dollar trades without slippage.

Seasoned traders often combine accounts for optimal efficiency. One might use high leverage for short-term forex plays while keeping index trades at lower ratios. This flexibility supports diversified portfolios without compromising individual strategy goals.

Account Opening Process and Identity Verification

Initiating a trading journey begins with a straightforward account setup process. Traders click the “Open a Live Account” button and complete a digital form with basic personal details. This streamlined approach works identically for both account types, maintaining regulatory compliance across all users.

Identity verification follows strict anti-money laundering protocols. Applicants must upload government-issued photo identification and recent proof of address documentation. These requirements protect traders and brokers alike while meeting international financial standards.

The absence of minimum deposit requirements removes entry barriers completely. Users can fund accounts with any amount aligning with their risk management strategies. This flexibility empowers beginners to start small while allowing experienced traders to scale operations gradually.

A demo account option lets newcomers practice strategies risk-free. This feature mirrors live trading conditions without requiring real capital. Traders gain confidence in platform features before committing funds, creating a safer learning environment.