How to Use xStation 5 on Mobile and Desktop – Full Guide for Beginners

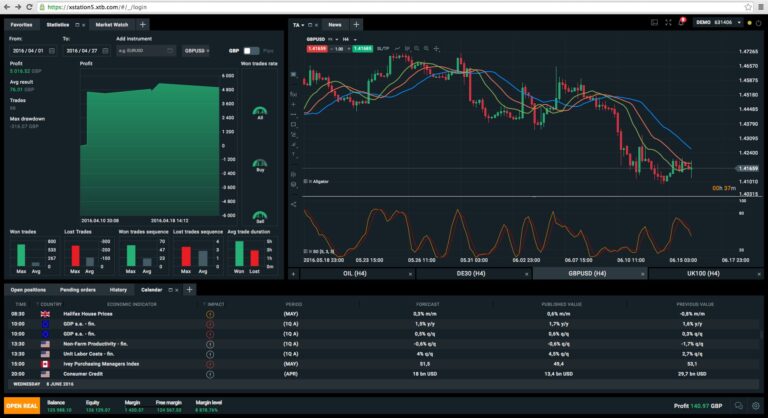

Navigating financial markets requires tools that balance power with simplicity. XTB’s proprietary browser-based platform delivers exactly that, offering seamless access to trading across devices without downloads. Whether analyzing forex pairs or exploring ETF CFDs, users get a unified experience on mobile and desktop. This guide breaks down the platform’s core features for beginners. Traders gain…