TMGM Broker Review: Trading Conditions and Fees Explained

This comprehensive analysis examines the trading platform that has evolved from a boutique Sydney FX operation into an international financial services provider. The company maintains its headquarters in Australia and has expanded globally since its establishment in 2013.

The review focuses specifically on the trading conditions and fee structures available to investors. It explores how this service provider positions itself in the competitive market with institutional-grade liquidity and raw-spread pricing.

Readers will discover detailed information about account options, minimum deposit requirements, and the extensive range of available instruments. The analysis incorporates regulatory oversight details and real user feedback to provide a balanced perspective.

This evaluation helps prospective clients determine whether the platform’s combination of features aligns with their investment goals. The examination covers execution speeds, commission structures, and overall cost-effectiveness for active market participants.

Introducing the TMGM Broker Experience

Founded by ex-interbank FX dealers, this platform emerged with a mission to deliver professional-grade trading conditions to everyday market participants. The business started operations in 2013 under the name TradeMax.

Overview of the Broker’s History and Growth

From its Sydney origins, the company expanded globally. A major rebranding to TMGM Group occurred in 2018. This change coincided with high-profile sponsorships that boosted its international profile.

The firm now employs over 400 people. It serves clients across South-East Asia and Latin America. This growth shows a strong commitment to expanding its services.

What Sets TMGM Apart?

The platform operates as a true ECN broker. It connects clients directly to top-tier liquidity providers. This ensures transparent pricing and direct market access.

Key advantages include institutional infrastructure and lightning-fast execution speeds. The service caters to diverse traders. It offers both raw-spread accounts for cost-conscious users and simpler options for beginners.

- True ECN model with no dealing desk

- Sub-30-millisecond execution speeds

- Connectivity through premium Equinix data centers

- Account structures for all experience levels

This combination creates a sophisticated yet accessible trading environment. It supports everyone from novices to algorithmic traders.

TMGM Broker Company Overview

The corporate structure reflects a strategic approach to international financial markets, with licensed entities across multiple continents. This multi-jurisdictional framework enables the business to serve clients globally while maintaining appropriate regulatory oversight in each region.

Headquartered in Sydney, the company operates through several subsidiaries with distinct regulatory licenses. These include Australian Securities and Investments Commission oversight for domestic operations and various international financial authorities for global services.

The organization’s expansion strategy involved establishing licensed entities in key regions worldwide. Offices span from Vanuatu and Kenya to Seychelles, Mauritius, and New Zealand. This geographic diversity accommodates traders operating under different regulatory frameworks.

As a privately held enterprise, the company has demonstrated consistent growth without external venture funding. The business model focuses on providing CFD and forex trading services through a no-dealing-desk approach. This eliminates potential conflicts of interest between the platform and its clients.

Transparency remains a cornerstone of operations, with clearly published corporate information available. Each subsidiary operates under specific financial services licensing appropriate to its jurisdiction. This structured approach supports the company’s commitment to regulatory compliance across all markets.

Regulatory Framework and Safety Measures

Multi-jurisdictional licensing arrangements form the backbone of client protection measures in international trading operations. This framework ensures compliance across different regions while maintaining appropriate oversight standards.

ASIC, VFSC, and Other Global Licenses

The platform operates under the Australian Securities and Investments Commission through its Australian entity. This tier-one regulator enforces strict retail derivatives rules with proactive oversight.

International operations fall under the Vanuatu Financial Services Commission, allowing different leverage options. Additional regional licenses include oversight from Mauritius, Kenya, and Seychelles authorities.

Each regulatory body provides specific protections for clients based on their jurisdiction. The securities investments commission framework ensures best execution standards are maintained.

Client Fund Segregation and Negative Balance Protection

Client funds receive protection through segregated trust accounts at National Australia Bank. This separation prevents creditor access to customer deposits during company financial issues.

Negative balance protection guarantees retail clients cannot lose more than their deposited amounts. This safety net applies specifically to accounts under Australian Securities and Investments Commission regulation.

Professional indemnity insurance provides additional coverage up to AUD 10 million. The Vanuatu entity also offers dispute resolution through The Financial Commission.

TMGM Broker Trading Conditions and Features

The choice between different account types represents a fundamental decision for traders seeking optimal market access. This platform structures its trading conditions around two primary models that cater to distinct preferences and strategies.

Raw-Spread Versus Spread-Only Accounts

TMGM offers the Classic account with spread-only pricing starting from 1.0 pip. This model includes no separate commission charges, simplifying cost calculations for traders.

The Edge account provides raw spreads from 0.0 pips plus a $7 commission per round-turn lot. This account delivers institutional-grade pricing for active participants who value transparency.

Both account types maintain a $100 minimum deposit requirement. The Edge account’s pricing structure makes total costs predictable during normal market conditions.

Lverage Options Across Different Entities

Leverage availability varies significantly based on regulatory jurisdiction. Australian and New Zealand retail clients face conservative 1:30 ratios for major forex pairs.

Offshore entities can offer leverage up to 1:1000 for qualified traders. This dramatic difference in leverage options reflects regional regulatory frameworks.

The execution model utilizes ECN technology with speeds under 30 milliseconds. Retail clients benefit from negative balance protection under specific jurisdictions.

Trading Fees and Cost Structures

Comprehensive fee analysis reveals the true cost of market participation beyond just advertised spreads. Traders should examine all expense components to understand total trading costs accurately.

Spreads and Commission Details

The platform offers two distinct pricing models. The Classic account features commission-free trading with floating spreads starting from 1.0 pips.

Live testing showed competitive spreads across various instruments. EURUSD averaged 0.9-1.0 pips, while gold maintained 18-21 pips during normal market conditions.

The Edge account provides raw spreads from 0.0 pips with a $7 commission per round-turn lot. This transparent pricing structure appeals to cost-conscious active traders.

Overnight financing fees represent additional considerations. Swap rates fluctuate based on interbank interest rate differentials, affecting long-term position costs.

Inactivity Fees and Non-Trading Charges

Non-trading expenses remain minimal with this service provider. The platform imposes no internal handling fees on deposits or withdrawals.

A $10 monthly inactivity fee applies only after 12 months of account dormancy. This policy proves more lenient than many competitors’ 90-180 day thresholds.

Withdrawal processing times range from 1-4 business days depending on the payment method. Bank transfers typically require longer processing than electronic wallet options.

Traders should verify potential third-party processing fees with their payment providers. The overall cost structure emphasizes transparency and competitive pricing.

Account Types and Minimum Deposit Insights

The platform’s account structure offers distinct pathways for traders based on experience level and financial goals. Each account type serves specific market participants with tailored features and requirements.

Classic, Edge, Swap-Free, and Cent Accounts

Four primary account categories provide options for different trading styles. The Classic account features commission-free trading with spreads starting from 1.0 pip. This account type suits beginners who prefer straightforward pricing.

The Edge account offers raw spreads from 0.0 pips with transparent $7 commissions. Active traders benefit from this account structure’s institutional-grade pricing. Both accounts maintain a $100 minimum deposit requirement.

Swap-Free accounts accommodate Islamic finance principles by eliminating overnight interest charges. Traders must request this account variant specifically through customer support.

The Cent account requires only a $15 minimum deposit, making it accessible for practice trading. This account type uses cent lots instead of standard positions. It supports limited instruments including major currency pairs and commodities.

All trading account options support six currency denominations. Traders can avoid conversion fees by selecting their local currency. The platform also provides copy trading services through its HUBx system.

TMGM Trading Platforms and Tools

Technology infrastructure plays a crucial role in modern trading operations, with platform selection directly impacting execution quality and analytical capabilities. The available software options cater to diverse trading styles and experience levels.

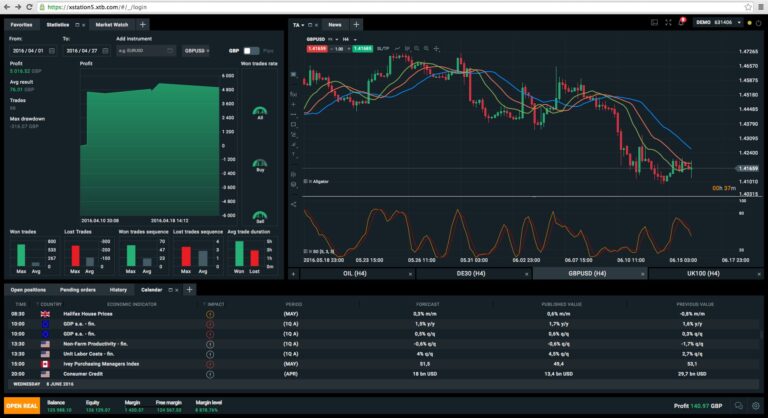

MetaTrader 4/5 and Mobile Applications

MetaTrader 4 and MetaTrader 5 represent the core trading platforms available to clients. These industry-standard solutions provide comprehensive charting packages and support for automated strategies through Expert Advisors.

The MT5 platform features 38 technical indicators and 24 drawing tools for detailed analysis. Mobile applications ensure traders can monitor positions and execute trades from any location.

Platform accessibility extends across desktop, web, and mobile interfaces. This multi-device approach supports various trading methods and lifestyles.

Additional Tools: HUBx and VPS Hosting

Beyond the standard platforms, specialized tools enhance the trading experience. HUBx serves as a social trading platform connecting signal providers with followers.

Free VPS hosting becomes available to accounts maintaining a $3,000 deposit and monthly volume requirements. This feature reduces latency to approximately 5 milliseconds for algorithmic strategies.

The proprietary mobile app integrates TradingView charts and Trading Central research. These additional features provide superior market intelligence and technical analysis capabilities.

Order Execution and Risk Management Features

Modern trading success hinges on both rapid execution capabilities and comprehensive risk management tools. The platform utilizes Electronic Communication Network technology to route orders directly to liquidity providers. This approach minimizes conflicts of interest and ensures transparent pricing.

Execution speeds average under 30 milliseconds thanks to premium infrastructure in Equinix data centers. This connectivity links traders directly to major banks and institutional market makers. The system adheres to strict best execution standards required by regulatory authorities.

Traders can place various order types including market orders for immediate execution. Pending limit and stop orders trigger when prices reach predetermined levels. One-click trading enables rapid entries and exits during fast-moving markets.

Risk management features provide essential protection for market participants. Stop-loss and take-profit orders can be attached to every position with no minimum distance restrictions. This flexibility allows traders to implement precise risk parameters suited to short-term strategies.

The service guarantees negative balance protection for retail accounts under specific regulatory oversight. This safety net ensures clients cannot lose more than their deposited capital during extreme market conditions. Most user reviews praise the execution quality, though some report slippage during high-volatility events.

Comprehensive order types including trailing stops support diverse trading approaches. The ability to modify open positions in real-time enhances risk control. These features work together to create a secure environment for active market participation.

Exploring TMGM’s Product and Instrument Offerings

Product diversity enables traders to build balanced portfolios through exposure to different market sectors and asset types. The platform provides access to over 150 CFD instruments across multiple categories.

This comprehensive selection supports various trading strategies and risk appetites. Traders can diversify their market exposure through a single account.

Forex, Indices, Commodities, and Share CFDs

The forex market features 56 currency pairs including major, minor, and exotic combinations. Live testing showed competitive spreads that benefit active currency trading.

Share CFDs represent a standout offering with access to over 12,000 individual stocks. Technology giants like Apple and Tesla showed particularly favorable pricing.

Commodity markets include precious metals and energy products with average spreads. Indices cover 19 global benchmarks from major economies worldwide.

Cryptocurrency trading encompasses 20 digital currency CFDs with cost-competitive spreads. This broad market selection accommodates diverse approaches to trading.

Promotions, Rewards, and Copy Trading Capabilities

Innovative reward programs and social trading features represent significant differentiators in the modern brokerage landscape. These value-added services extend beyond basic execution to create more engaging experiences for market participants.

Performance-Based Rewards and Copy Trading

The platform’s unique “lots to points” framework rewards active trading volume and consistency. This performance-based system provides ongoing benefits rather than one-time bonuses.

Traders accumulate points based on their trading activity. These points can offset costs like spreads and commissions. High-volume participants find this particularly valuable.

Social trading capabilities are delivered through the HUBx platform. This specialized system connects experienced signal providers with followers seeking to replicate successful strategies.

The copy trading service benefits both user groups. Signal providers can monetize their expertise. Followers gain access to professional approaches while learning market techniques.

Advanced tools within HUBx ensure transparent performance tracking. Followers can review historical returns and risk metrics before selecting strategies to copy.

Customer Support and Service Quality

Effective customer support serves as a critical component for traders navigating fast-moving financial markets. The quality of assistance can significantly impact trading outcomes during critical moments.

Available assistance operates continuously throughout the trading week. Multiple contact methods ensure accessibility for diverse user preferences.

Multilingual 24/7 Support Channels

Round-the-clock availability addresses time zone differences across global markets. Support channels include live chat, email, and telephone options.

Multilingual services remove language barriers for international clients. Assistance is available in English, Chinese, Vietnamese, Spanish, and Portuguese.

Testing revealed impressive response times under one minute. Support agents demonstrated strong product knowledge during interactions.

User Feedback on Assistance and Response Times

User reviews frequently highlight specific account managers by name. Professionals like Millan and Mario Romeo receive consistent praise for their responsiveness.

Most traders describe support teams as polite and genuinely helpful. This suggests effective training programs for customer service staff.

Some negative feedback mentions delays in resolving technical issues. Connection requests for dedicated account managers sometimes experience extended wait times.

The overall quality of customer services receives positive marks from retail traders. High-volume users occasionally report longer resolution periods for complex matters.

User Reviews and Real Trading Experiences

Customer reviews offer a transparent window into the practical realities of using this financial service provider. The platform maintains a strong 4.2-star Trustpilot rating based on 828 reviews.

This consistent positive feedback suggests most traders find the service meets their expectations. The collective experience reveals both strengths and areas needing attention.

Positive Trading Experiences

Many traders highlight exceptional execution quality as a key benefit. One seven-year veteran described the conditions as “unmatched” with minimal slippage during news events.

Users frequently praise the withdrawal process, noting “instant” fund transfers. The multilingual support team receives consistent appreciation for their responsiveness.

Traders value the competitive spreads and performance-based rewards program. These features create a positive trading experience for active market participants.

Areas of Improvement Reported by Traders

Some users report delays in account manager responses, with wait times exceeding 20 working days. Documentation requirements for larger withdrawals can frustrate traders.

Canadian residents face practical challenges with deposit methods. Major banks sometimes block credit card transactions to the platform.

During volatile markets, some traders experience slippage that affects precise entries and exits. These occasional issues represent opportunities for service enhancement.

TMGM Broker for UK Traders: What to Know

British traders exploring this platform face unique considerations regarding regulatory protections and leverage options. The service provider operates without Financial Conduct Authority authorization for UK residents.

Clients from the United Kingdom are onboarded under the offshore Vanuatu entity rather than the Australian-regulated operation. This arrangement means British traders fall outside the Financial Services Compensation Scheme and FCA investor protection measures.

The offshore structure allows significantly higher leverage ratios up to 1:1000 compared to the FCA’s 1:30 limit for retail traders. While this enables larger positions with smaller capital, it dramatically increases potential losses.

Despite the offshore arrangement, client funds receive protection through segregated accounts at National Australia Bank. The Vanuatu entity maintains Professional Indemnity insurance coverage of AUD 10 million.

UK traders should weigh the benefits of competitive spreads and extensive instrument selection against reduced regulatory safeguards. Dispute resolution occurs through The Financial Commission rather than the UK Financial Ombudsman Service.

Trading conditions remain consistent for British clients, including access to both account types with $100 minimum deposits. The platform’s membership in The Financial Commission provides alternative protection up to EUR 20,000.

Expert Opinions and Market Analysis

Industry experts provide valuable perspectives on trading platforms through detailed market analysis. Richard Perry, a recognized technical analysis specialist, offers strategic insights into this service provider’s competitive positioning.

Perry notes the platform appeals to cost-conscious forex scalpers through its Edge account. Simultaneously, it courts novice traders via its spread-only Classic plan. This dual approach serves different experience levels effectively.

The strongest advantages identified include transparent low-cost pricing structures. Experts also highlight the blend of regulatory oversight and extensive share CFD access. These features create significant value for active market participants.

Market professionals caution about leverage variations across different jurisdictions. The most attractive ratios appear under offshore licenses with weaker protection. Australian and New Zealand residents face conservative product limits.

Analysis suggests the platform particularly suits algorithmic traders and news scalpers. Multi-asset traders benefit from accessing global equities through one margin pool. The ECN execution model ensures minimal conflicts of interest.

Expert opinions characterize this service as competitively positioned for cost-sensitive approaches. The execution infrastructure with sub-30-millisecond speeds supports high-frequency strategies effectively.

Final Reflections on the TMGM Broker Review

The final assessment reveals TMGM as a specialized service provider catering to traders who prioritize execution quality and transparent pricing. The platform’s multi-regulator authorization and client fund segregation provide essential safety measures for market participants.

Competitive advantages include institutional-grade infrastructure with sub-30-millisecond execution speeds. The Edge account’s raw-spread model delivers cost efficiency for active trading strategies. Access to over 12,000 share CFDs creates significant portfolio diversification opportunities.

Traders should consider jurisdictional differences between ASIC-regulated and offshore entities. The service particularly suits algorithmic FX specialists and multi-asset participants. While educational resources remain limited, the 4.2-star Trustpilot rating reflects positive user experiences.

This TMGM broker review concludes the platform offers compelling value for cost-conscious traders seeking professional trading conditions. The combination of regulatory oversight, competitive pricing, and extensive market access positions it well in the competitive brokerage landscape.