How to Use xStation 5 on Mobile and Desktop – Full Guide for Beginners

Navigating financial markets requires tools that balance power with simplicity. XTB’s proprietary browser-based platform delivers exactly that, offering seamless access to trading across devices without downloads. Whether analyzing forex pairs or exploring ETF CFDs, users get a unified experience on mobile and desktop.

This guide breaks down the platform’s core features for beginners. Traders gain access to over 2,000 instruments, from commodities to global indices. The interface adapts to different skill levels, blending intuitive design with advanced charting tools for technical analysis.

Security remains a priority. Since 2017, XTB has enforced negative balance protection, ensuring losses never exceed deposited funds. Combined with FCA regulation in the UK, this creates a safer environment for managing risks.

New users can practice with $100,000 in virtual funds through a demo account. This four-week trial helps build confidence before transitioning to live trading. Real-time market data and one-click execution keep strategies responsive across all devices.

Introducing xStation 5: Overview and Key Benefits

In today’s fast-paced markets, having a reliable trading platform is essential for both new and experienced traders. XTB’s solution combines smart design with robust security, creating an environment where users can analyze trends and execute strategies efficiently.

Streamlined Layout for Efficient Trading

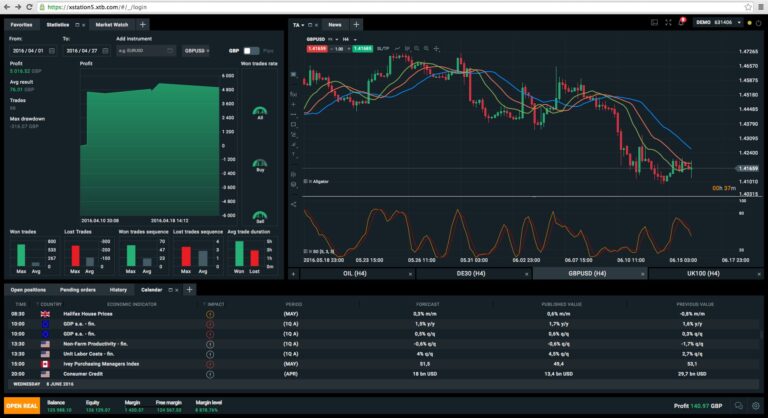

The interface organizes tools into three clear sections. The Chart Window provides 29 drawing tools and 37 technical indicators for detailed analysis. Traders can track forex pairs or stock CFDs using real-time sentiment data and economic calendars.

On the left, Market Watch displays live prices for over 2,000 instruments. Users save favorite assets and open trades in one click. Below, the Terminal manages orders, margin levels, and account history without switching screens.

Protecting Client Funds and Data

Security measures include FCA-regulated safeguards and automatic risk controls. Since 2017, negative balance protection ensures losses never exceed deposited funds. Custom workspaces let traders separate strategies while maintaining strict security protocols.

Multi-monitor setups and detachable charts support advanced workflows. Whether testing ideas with virtual funds or managing live positions, the platform adapts to individual needs while prioritizing safety.

Getting Started on Mobile and Desktop

Accessing financial tools across devices has become crucial for modern traders. XTB’s platform ensures a smooth transition between smartphones and computers, letting users manage portfolios anywhere. Beginners can quickly activate their account and explore features through a unified interface.

Logging In and Account Setup

New users start by visiting XTB.com and clicking the login button in the top-right corner. Email and password authentication takes seconds, with a password recovery option for forgotten credentials. Once logged in, a dropdown menu lets traders switch between demo and live accounts instantly.

The demo account offers $100,000 in virtual funds for risk-free practice. This four-week trial includes premium educational courses to sharpen skills. Real-time market data remains identical to live trading, ensuring accurate strategy testing.

Downloading the App and Accessing the Demo Account

Mobile users search “xStation” on Google Play or the App Store to download the app. Android and iOS versions provide full functionality, including one-click order execution. Desktop software for Windows and Mac enhances charting capabilities for detailed analysis.

After installation, the same login details grant access to all features. Tutorial videos and economic calendars appear immediately, helping beginners navigate the platform. Whether testing ideas or executing live trades, tools adapt seamlessly across devices.

Navigating the xStation 5 Platform Modules

Mastering platform efficiency separates proactive traders from reactive ones. Three core modules form the backbone of the system: real-time chart analysis, customizable market watch lists, and a centralized trading terminal. Each component adapts to individual strategies while maintaining intuitive navigation.

Exploring the Chart Window and Analytical Tools

The chart window transforms raw data into actionable insights. Traders access sentiment indicators, heat maps, and economic calendars alongside 37 technical indicators. Countdown timers on candlesticks highlight remaining time for price movements, while news event markers align with chart axes.

Performance statistics track trading accuracy and profit patterns automatically. Stock screeners filter instruments by volume or volatility, helping identify opportunities in forex pairs or indices. Interactive overlays let users compare commodity prices against historical trends.

Customizing Market Watch and Terminal Views

Market watch lists become strategic dashboards through smart organization. Users group commodities, currencies, and ETFs into collapsible sections. Forex pairs split into majors, minors, and emerging markets for faster navigation.

The terminal module displays real-time margin levels and open positions. Traders adjust stop-loss orders or analyze cash operations without switching screens. Hover tooltips in market watch provide instant asset details, from spread sizes to contract specifications.

Placing Trades on xstation 5: Step-by-Step Process

Executing trading strategies efficiently requires mastering order placement techniques. The platform offers three intuitive methods to place trade positions, each designed for different market scenarios. Traders benefit from real-time calculations and customizable risk management tools within every order window.

Using Market Watch for Order Placement

Double-click any instrument in the market watch list to launch the deal ticket. This window displays spread costs, commission fees, and swap rates in both pips and currency values. Key features include:

- Adjustable position sizes via volume sliders

- Simultaneous stop loss and take profit level inputs

- One-click execution after confirming order details

Placing Trades Directly from the Chart and Order Window

The chart interface contains dedicated buy/sell buttons for instant action. Hover over price points to set entry levels visually. Advanced users enable three-click trading:

- Click the pending order icon

- Select entry and exit points on the chart

- Review calculations before confirming

Experienced traders can disable confirmation pop-ups for faster execution. Beginners should keep these prompts active to avoid costly mistakes. All methods update margin requirements instantly, helping maintain proper risk control.

Leveraging Advanced Features and Tools

Successful traders maximize opportunities through smart tool utilization. The platform’s advanced features streamline complex strategies while keeping costs predictable. Two standout capabilities redefine how users interact with global markets.

Utilizing Investment Baskets and Custom Workspaces

Investment baskets let traders bundle related financial instruments like tech stocks or energy commodities. Execute simultaneous long/short positions across 15+ assets with one click. This thematic approach saves time while diversifying exposure.

Custom workspaces support up to 16 detachable charts. Professionals arrange currency pairs alongside indices on multiple monitors. Saved layouts recall preferred technical indicators and drawing tools instantly.

Staying Informed with News, Economic Calendars, and Sentiment Data

The economic calendar filters events by country and currency impact. Compare central bank forecasts against actual rate decisions. Real-time news alerts highlight market-moving developments.

Key features for informed decisions:

- Sentiment meter showing XTB clients’ aggregate positions

- Stock scanner with P/E ratios and dividend yield filters

- Zero commission stocks & ETFs under €100k monthly turnover

A 0.5% currency conversion cost applies when trading cross-border assets. This transparent pricing helps calculate potential profit margins accurately before executing trades.

Final Thoughts on Mastering the Platform for Trading Success

Balancing innovation with accessibility remains crucial in modern trading platforms. XTB’s solution excels through its intuitive design, offering professional-grade tools without overwhelming new users. Three-click chart execution and portfolio baskets demonstrate how the platform simplifies complex strategies.

Mobile and desktop versions maintain near-parity, though price alerts work best on web interfaces. Algorithm-focused traders might miss backtesting features, but manual strategists gain robust charting tools and real-time sentiment data. Tight spreads across 2,000+ instruments keep costs predictable for stock and CFD traders.

The demo account stands out as a learning accelerator. Four weeks of risk-free practice with tutorial videos helps build confidence before live trading. While automation options lag behind MetaTrader, the platform’s API support bridges some gaps for tech-savvy users.

Success hinges on leveraging XTB’s strengths: swift order execution, cross-device flexibility, and educational resources. For most traders outside algorithmic niches, this platform delivers a complete toolkit for navigating global markets effectively.