XTB Fees and Commissions: A Comprehensive Overview

Understanding pricing structures is critical for anyone entering financial markets. Traders need clarity on how costs affect profits, especially when choosing a platform. This guide breaks down the essential details to help users navigate expenses effectively.

XTB provides three account options, each tailored to specific strategies and regulatory needs. The Standard account suits casual investors, while the Pro version caters to high-volume participants. An Islamic option adheres to Sharia principles, ensuring flexibility for diverse preferences.

Costs vary across accounts, including spreads, overnight charges, and commissions. These elements combine to shape overall expenses, making it vital to compare options. Over 2,500 instruments—from forex to cryptocurrencies—are available, offering ample opportunities across asset classes.

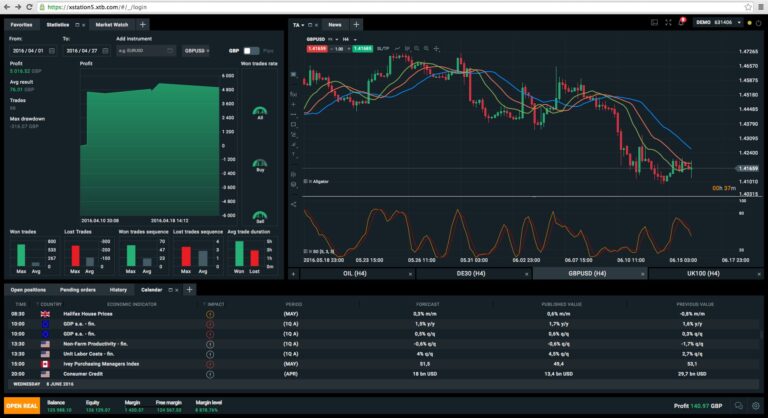

Transparency remains a priority for the platform. Users gain access to proprietary tools like xStation, designed to streamline decision-making. By evaluating all factors, traders can align their choices with personal goals and risk tolerance.

Introduction to XTB Trading Costs

Cost transparency separates successful traders from those guessing outcomes. Platforms structure expenses differently, and grasping these models helps users optimize strategies. Three account types—Standard, Pro, and Islamic—offer distinct approaches to managing expenses.

The Standard account bundles all trading costs into spreads. This means the difference between buy and sell prices covers platform charges, simplifying calculations. Most CFD markets here operate without commissions, except Equity CFDs and ETFs.

Minimum trades start at 0.01 lots, allowing participation with smaller capital. Leverage for EU-based traders follows strict 1:30 limits under ESMA rules. These safeguards prevent excessive risk while maintaining market access.

Commission-free trading applies to forex, commodities, and indices. However, stock and ETF positions incur separate fees. Spreads adjust dynamically based on market conditions, requiring traders to monitor real-time data.

Flexibility remains central to the platform’s design. The Islamic account eliminates swap charges for overnight positions, adhering to religious guidelines. Each option balances accessibility with regulatory compliance, catering to diverse needs.

Understanding xtb fees and commissions

Effective trading strategies require a clear grasp of platform charges. Two primary account models exist for managing these expenses: one integrates costs into spreads, while the other combines tighter spreads with separate transaction fees.

The Standard account uses spread-based pricing. All operational charges are embedded within the bid-ask difference, simplifying calculations for casual traders. This approach works well for forex, indices, and commodities—no separate fees apply for these instruments.

Active participants often prefer the Pro account. It offers narrower spreads but adds a $3.50 charge per trade side. A full transaction—opening and closing a position—totals $7.00. This hybrid model benefits high-volume traders seeking lower overall costs.

Safety measures protect users from extreme market shifts. Negative balance protection ensures accounts never dip below zero, even during volatility. Client funds remain segregated from company assets, adding an extra layer of financial security.

Transparency defines these structures. Spreads adjust dynamically based on liquidity, while commissions remain fixed. By matching account features to trading habits, individuals can optimize their expense management effectively.

Exploring XTB Account Types and Fee Structures

Selecting the right financial platform requires matching account features to individual strategies. Three distinct options cater to different trading styles: Standard, Pro, and Islamic. Each model balances accessibility, regulatory compliance, and expense management.

Standard Account: Spread-Based Pricing

Ideal for retail participants, this option integrates all costs into spreads. Forex, indices, and commodities trades carry no separate commissions. Equity CFDs and ETFs remain exceptions, with fees applied per transaction.

EU-based users face 1:30 leverage limits under ESMA guidelines. This protects casual traders from excessive risk while maintaining access to 2,500+ instruments. Spreads adjust dynamically, requiring real-time monitoring for optimal entry points.

Pro Account: Commission and Lower Total Costs

Active traders benefit from narrower spreads paired with transparent commissions. Each trade side incurs a $3.50 charge, totaling $7.00 per round trip. High-volume strategies often offset this through reduced overall expenses.

Enhanced leverage remains unavailable for EU retail clients. However, professionals gain tighter pricing across forex and CFD markets. This hybrid model suits those executing frequent, large-scale positions.

Islamic Account: Swap-Free Trading and Cashback Benefits

Designed for adherence to Sharia principles, this option eliminates overnight interest charges. Traders in the UAE, Saudi Arabia, Egypt, and Malaysia access 1:500 leverage on select instruments. Cashback programs reward consistent activity.

Over 1,500 markets remain available, including major forex pairs and indices. Regional regulations influence maximum leverage, with some jurisdictions permitting higher ratios than EU standards.

Practical Examples of Calculating Trading Costs

Real-world math separates theoretical knowledge from actionable strategies. Let’s examine how expenses materialize in popular markets using concrete scenarios.

Forex Example: EUR/USD Cost Calculation

A Standard account charges costs through spreads. For one standard lot (100,000 units) on EUR/USD, a 0.9 pip spread equals $9 per trade side. Opening and closing positions totals $18.

The Pro account combines tighter spreads with commissions. The same trade carries a 0.1 pip spread ($1) plus $3.50 per side. Round-trip costs drop to $9—half the Standard account’s expense.

Standard vs Pro Account Cost Comparison

Spread differences across pairs influence savings potential. USD/JPY costs 1.4 pips on Standard vs 0.2 pips on Pro. GBP/USD shows 2.2 pips versus 0.3 pips. Narrower spreads offset Pro’s fixed commissions in most cases.

Position sizing matters. Micro lots (1,000 units) reduce per-trade expenses but increase relative commission impact. Larger volumes amplify Pro account savings due to spread reductions.

Choosing between models depends on frequency and volume. Casual traders may prefer simplicity, while active participants benefit from hybrid pricing.

Overnight Funding and Non-Trading Cost Considerations

Managing trading expenses requires attention to both active positions and account maintenance. Beyond spreads and commissions, traders must account for overnight financing and administrative charges that accumulate over time.

Understanding Swap Rates and Rollover Fees

Holding positions overnight triggers swap rates—interest adjustments based on market conditions. These charges vary by instrument and direction:

- EURAUD and USDMXN often show higher swap accruals

- Positive swaps credit accounts when holding certain positions

- Negative swaps deduct funds for opposing trades

The xStation platform provides real-time swap calculators. Traders can preview costs before execution, helping avoid unexpected deductions.

Inactivity and Currency Conversion Fees

Accounts face a €10 monthly charge after 365 inactive days or 90 days without deposits. Withdrawal fees apply only for transactions below €100, costing €10 per request.

Currency conversions carry these charges:

- 0.5% fee for weekday transfers

- 0.8% surcharge on weekends/holidays

All deposit methods remain free, supporting seamless funding across bank cards and e-wallets. Regular activity helps minimize additional costs while maintaining account flexibility.

Final Insights on Navigating XTB Trading Expenses

Smart traders evaluate both visible and hidden expenses before committing. XTB’s multi-tiered structure accommodates diverse strategies through three distinct models. Standard accounts simplify costs via integrated spreads, while Pro versions reward volume with tighter pricing and transparent charges. Islamic options remove swap fees, aligning with specific regional requirements.

Leveraged positions amplify potential gains but demand caution. Over 70% of retail accounts lose money when trading CFDs, as complex instruments carry high risk. Rapid losses can occur due to market volatility and leverage effects, particularly with stocks and indices.

Selecting the right model depends on trade frequency, position sizes, and location. High-volume participants often benefit from Pro account structures despite explicit charges. Regularly monitoring overnight funding and withdrawal patterns helps minimize unnecessary costs.

This platform supports various financial goals while prioritizing transparency. By aligning account features with personal objectives, traders can navigate markets more effectively. Always assess total expenses—not isolated fees—to optimize long-term outcomes.