XTB Inactivity Fee 2026: When It Applies and How to Avoid It

Managing costs is a critical part of successful investing. For traders using various online platforms, understanding all potential charges is essential. This guide focuses on a specific fee that can affect users who do not trade regularly.

This particular charge is a monthly £10 fee. It applies after an account shows no activity for 12 consecutive months. The charge also applies if no deposit is made within a 90-day period.

XTB is a well-established broker with strong European regulation. The platform serves over a million clients globally. It offers access to a wide range of financial instruments.

This article provides a clear breakdown of the policy for 2026. Readers will learn the exact conditions that trigger the charge. More importantly, it offers practical strategies to avoid it completely.

Understanding the XTB Inactivity Fee Landscape

Exploring how a platform handles dormant accounts provides insight into its client engagement strategy. This section breaks down the specific mechanics and recent history of this policy.

How the Inactivity Fee is Calculated

The charge applies under two clear conditions. An account must see no trading activity for 12 consecutive months. Alternatively, it applies if no new deposit is made within a 90-day window.

For users with more than one real account, the calculation is performed separately for each. Activity on one profile does not offset dormancy on another.

A significant exemption exists for holders of physical assets. Owning even a single stock or ETF share in your portfolio completely waives the charge. This offers a simple path for long-term investors to avoid costs.

Historical Context and Changes in 2026

The broker has a history of improving accessibility. In 2020, it eliminated the minimum commission for stocks and ETFs. This move opened the platform to investors of all sizes.

For 2026, the structure remains consistent with industry norms. This stability allows users to plan with confidence. The policy aims to encourage regular platform use while providing fair avenues to prevent the charge.

Key Features of the xtb inactivity fee

The structure of platform charges reveals important details about how financial services providers value active client engagement. This section examines the specific characteristics that define this policy.

Definition and Fee Criteria

The charge applies under clear conditions. An account must show no trading activity for 12 consecutive months. Alternatively, it triggers if no deposit occurs within 90 days.

A significant protection exists for users with zero balances. The platform cannot create negative balances through these charges. This prevents unexpected debt accumulation.

Several strategies help avoid the charge completely. Making one small trade annually satisfies the activity requirement. Holding physical assets like stocks or ETFs also exempts users.

Comparison to Other Broker Fees

When measured against competitors, this policy aligns with industry standards. The £10 monthly charge matches what other major platforms implement after similar periods.

Some brokers offer longer grace periods but charge higher amounts. Others have more complex fee structures that can confuse users. The straightforward approach here provides clarity for account management.

Multiple account holders benefit from independent evaluation. Each profile is assessed separately, allowing flexible investment strategies across different portfolios.

XTB Fee Structure Overview

Different account types offer varying cost structures that can significantly impact trading outcomes. The platform provides clear options tailored to different activity levels and strategies.

Spread, Commission, and Non-Trading Fees

The Standard account uses a spread-based model. All trading costs are built into the difference between buy and sell prices.

This approach means no separate commissions for most markets. The spread for popular pairs like EUR/USD starts from 0.9 pips.

Traders seeking tighter spreads can choose the Pro account. This option offers spreads as low as 0.1 pips but includes a commission of $3.50 per side.

Physical stock and ETF trading represents a competitive advantage. Accounts with monthly volume under €100,000 pay zero commission.

These instruments also benefit from minimal spreads under 0.1%. This makes long-term investing particularly cost-effective.

Non-trading fees include deposit and withdrawal charges. Bank transfers and PayPal deposits are free, while card payments incur small percentage fees.

The fee structure scales with account size and activity. Larger accounts face different pricing tiers based on volume and portfolio value.

Avoiding the Inactivity Fee: Strategies and Tips

Smart investors employ simple techniques to maintain their account status without incurring extra costs. These approaches require minimal effort while ensuring continuous platform access. Understanding these options helps traders plan their activities effectively.

Maintaining Regular Trading Activity

The most straightforward method involves executing at least one trade annually. This can be a minimal position costing approximately €1. Even small transactions reset the activity clock effectively.

Some traders prefer purchasing fractional shares of high-value companies. This allows maintaining active status with minimal capital commitment. The approach works well for those who want exposure to premium stocks.

Holding physical assets provides permanent protection against charges. Owning just one share of stock or ETF unit creates an exemption. This strategy suits long-term investors perfectly.

Simple Account Movements to Prevent Fees

Transferring funds between accounts in the same currency counts as valid activity. This movement incurs no additional costs. It’s an efficient way to maintain status without actual trading.

Withdrawing all funds creates a zero balance that cannot be charged. This effectively freezes the account temporarily. The approach works for traders taking extended breaks.

Setting calendar reminders 10-11 months after the last activity prevents accidental triggers. This simple organizational habit ensures timely action. It’s one of the most effective prevention methods available.

Managing Your Account Balance and Trading Activity

Beyond just placing trades, effective oversight of account funds and transaction timing plays a crucial role in overall financial strategy. Smart management turns a simple balance into a dynamic tool for growth.

One significant advantage is the ability to earn interest on uninvested cash. Depending on portfolio size, rates can reach up to 4.9% on GBP balances. This means funds awaiting deployment can generate passive income.

The Importance of Timely Transactions

Transaction timing is critical for maintaining an active status. The platform requires a deposit at least every 90 days to help avoid becoming classified as dormant after a full year.

Using free deposit methods like bank transfer is a strategic move. It prevents the small fees associated with card payments. This approach keeps more capital working for you.

Regularly monitoring your account balance and history is essential. The xStation 5 platform provides clear tools for this. Staying aware helps you take timely action.

Understanding withdrawal fees also aids in planning. Consolidating withdrawals above £50 eliminates the £5 charge for smaller amounts. This simple habit optimizes cash flow.

For those with multiple accounts, transferring funds between them in the same currency counts as valid activity. It offers flexibility without cost, enabling better capital allocation across different strategies.

Demystifying Other XTB Fees

When trading across global markets, understanding conversion charges becomes essential for cost management. These fees apply when transactions involve different currencies than the account denomination.

The platform implements a straightforward currency conversion structure. Traders should be aware of the specific rates and timing considerations.

Understanding Currency Conversion and Transaction Fees

Currency conversion fees stand at 0.5% during weekdays. This rate increases to 0.8% on weekends and holidays. The difference reflects varying market liquidity conditions.

Account denomination significantly impacts fee exposure. EUR account holders pay conversion fees when buying US stocks or ETFs in USD. They also face charges for instruments in GBP, CZK, or PLN.

USD account holders avoid internal conversion fees on US stocks and ETFs. However, they encounter bank charges during deposit conversion. These typically range from 1.5% to 3%.

Strategic account selection based on primary markets reduces cumulative costs. Traders focused on US markets benefit from USD accounts. Those trading European instruments may prefer EUR denominations.

Timing transactions during weekdays maximizes savings. The 0.5% weekday rate offers better value than weekend trading. This simple planning technique optimizes overall expense management.

How Inactivity Impacts Your Investment Portfolio

Even small, recurring charges can silently diminish investment returns over time. They create hidden obstacles to financial goals. For an account holding £1,200, a full year of monthly charges represents a 10% reduction in portfolio value.

The psychological impact extends beyond direct costs. Dormant accounts often signal disengagement from investment objectives. This disconnect can cause investors to miss market opportunities or neglect portfolio rebalancing.

Holding physical assets like stocks and ETFs provides dual benefits. It prevents charges while maintaining exposure to potential appreciation. This strategy works well for long-term investors.

XTB’s Investment Plans feature addresses these concerns effectively. Users can set up automatic investments into selected ETFs. This maintains account activity while building diversified portfolios.

Portfolio preservation requires active monitoring even for buy-and-hold strategies. Market conditions and personal circumstances evolve. Regular review ensures alignment with financial objectives.

The compounding effect of avoided charges becomes substantial over decades. Preventing annual charges over 20 years saves £2,400 plus opportunity costs. Automated features transform potential liability into disciplined wealth-building.

Evaluating XTB’s Competitive Pricing and Broker Services

Investors choosing a brokerage service need to evaluate how pricing and features align with their trading style. This comparison helps identify the best value among available options.

The platform stands out for its balanced approach to costs and functionality. It provides access to extensive global markets through user-friendly tools.

Comparing Fee Models across Competitors

XTB offers access to over 5,600 instruments across multiple asset classes. This includes forex, commodities, indices, stocks, ETFs, and CFDs. The diversity meets most retail traders’ needs effectively.

Market access extends to 16 major international exchanges. This positions the broker competitively against eToro’s 17 exchanges. It surpasses Freetrade’s 11 and Trading 212’s 14 exchange connections.

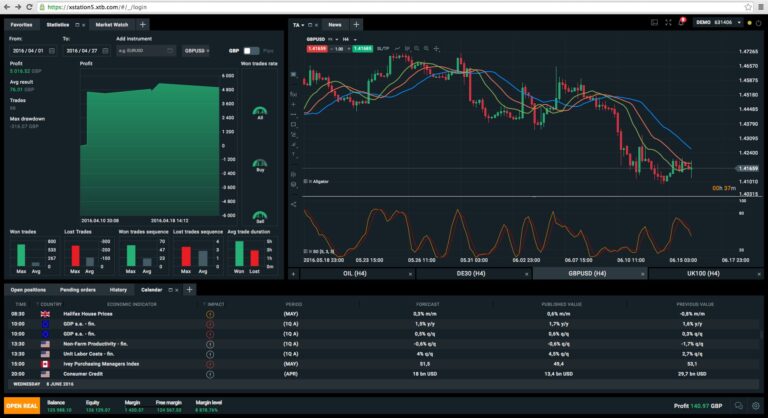

The proprietary xStation 5 platform delivers professional analytics and real-time data. These tools help traders make informed decisions across different markets. The integration of market sentiment indicators adds significant value.

Fee structures provide flexibility for various trading profiles. Standard accounts use spread-based pricing suitable for beginners. Pro accounts offer commission-based models for high-volume traders.

Additional services enhance the overall broker experience. Educational resources and automated Investment Plans support long-term strategy development. Interest on uninvested cash provides extra value beyond basic trading functions.

Understanding the Role of Spread and Leverage in Trading

Two critical components that every market participant must understand are the pricing mechanism and capital efficiency tools. These elements directly impact both trading costs and potential returns.

The spread represents the difference between buy and sell prices. This gap incorporates all trading costs without separate commission charges.

Spread-Only Trading Explained

Spread-only trading serves as the core pricing model for Standard accounts. Costs are built directly into the price difference between bid and ask levels.

Market conditions determine spread fluctuations. Liquidity and volatility cause these trading costs to vary dynamically rather than remaining fixed.

Typical EUR/USD spreads start around 0.9 pips. This approach provides transparency for traders evaluating entry and exit points.

Risks and Benefits of Leverage

Leverage allows control of larger positions with smaller capital. A €1,000 account using 5x leverage can open a €5,000 position.

Every 1% market movement creates a 5% account impact. This amplification works in both directions for gains and losses.

EU regulations cap retail leverage at 30:1 for protection. Professional traders may access higher ratios up to 500:1 on certain instruments.

Statistics show 73-77% of retail accounts lose money trading CFDs with leverage. Understanding these dynamics remains essential for responsible trading decisions.

Tips for Beginners: Navigating the XTB Platform and Fees

New investors often face the challenge of navigating complex financial interfaces, making user-friendly design essential. The platform addresses this by offering a clean layout that reduces intimidation for first-time users. Three main navigation tabs provide straightforward access to core functions.

Opening an account follows a simplified process with clear fee disclosure. This transparency helps beginners understand costs from the start. The interface prioritizes accessibility over complexity.

User Experience and Educational Resources

Educational materials represent a significant advantage for new traders. The platform organizes learning content into fifteen-plus categories. These range from basic investment concepts to advanced technical analysis.

Beginners should start with the “ABC of Investing” and “Guides” sections. These foundational resources build essential knowledge before moving to specific instruments. The search functionality allows self-paced learning focused on individual goals.

The free demo account serves as an invaluable training ground. Users practice with virtual funds while experiencing real market conditions. This risk-free environment helps build confidence before live trading.

Practical tips include starting with unleveraged stock and ETF purchases. The Investment Plans feature enables automated diversification. Understanding the complete fee structure early helps optimize trading economics.

Advanced Trading Strategies for Professionals on XTB

Professional traders require access to diverse financial instruments and analytical tools to execute advanced market strategies effectively. The platform offers extensive resources for sophisticated approaches beyond basic investment methods.

Utilizing CFDs, ETFs, and Access to Market Data

Experienced traders leverage the extensive CFD offerings to implement complex strategies. With over 2,332 CFDs available, professionals can engage in pairs trading, sector rotation, and hedging across multiple asset classes simultaneously.

The platform provides 71 forex currency pairs spanning major, minor, and emerging market categories. This enables currency speculation based on macroeconomic trends and interest rate differentials. Access to 32 global indices allows for broad market exposure strategies.

Commodities CFDs across six categories offer portfolio diversification and inflation hedging opportunities. Professionals utilize nearly 2,000 stock CFDs and 171 ETF CFDs for multi-leg strategies and sector-specific positions.

The xStation 5 platform delivers professional analytics tools and technical indicators that support detailed market analysis. Real-time pricing data and market sentiment indicators help traders make informed decisions.

Advanced strategies require understanding overnight funding costs and margin requirements. Market data integration includes economic calendar features for event-driven trading approaches. These tools enable professionals to manage risk effectively across complex positions.

Monitoring Market Trends and Platform Updates

Real-time market monitoring capabilities provide traders with the insights needed to respond quickly to economic events. The platform integrates multiple research tools that help users stay informed about current conditions.

A comprehensive market calendar tracks high-impact economic releases. These include employment reports, GDP figures, and central bank decisions. Market sentiment indicators show buyer versus seller percentages for specific assets.

Traders can quickly identify trending instruments through real-time gainers and losers lists. Expert-curated research articles from in-house analysts provide context for market movements. This combination helps develop a complete understanding of emerging opportunities.

The platform receives regular updates that enhance functionality and user experience. XTB offers planned additions like bond trading and social features to expand available instruments. Continuous improvement reflects the company’s commitment to serving evolving trading needs.

Securing Your Account: Login, Verification, and Safety Measures

Account security forms the foundation of any trustworthy online trading experience. The platform implements multiple layers of protection to safeguard user information and financial assets.

Users can choose their preferred access method during login. Options include traditional passwords, numeric codes, or biometric fingerprint authentication on mobile devices.

Multi-Factor Authentication and Encryption

All connections between devices and the platform’s servers use advanced encryption technology. This prevents third parties from intercepting sensitive data during transmission.

The system recently introduced two-factor authentication for enhanced security. This requires verification through secondary channels when making important changes or logging in from new devices.

Fund protection mechanisms ensure money can only transfer to accounts registered in the client’s name. This prevents unauthorized withdrawals even if login credentials are compromised.

Before the first withdrawal, traders must complete verification by uploading a bank account statement. This process confirms ownership and complies with financial regulations.

Users should enable all available security features and monitor their account regularly. Strong, unique passwords and cautious credential management provide additional protection against cyber threats.

XTB’s Mobile Trading App and Usability Highlights

The evolution of trading technology now places mobile applications at the forefront of investment management tools. Modern traders expect seamless access to markets regardless of their location or device.

This platform’s mobile solution extends full functionality to smartphones and tablets. Users can monitor positions and execute trades with the same capabilities as desktop versions.

Features of the xStation 5 Platform

The mobile app receives frequent updates that enhance existing features. User reviews consistently praise its intuitive interface and responsive performance.

Cross-device compatibility extends to smartwatch integration. Traders receive price alerts and can monitor positions from wearable devices.

Fractional share trading represents a significant usability enhancement. Investors can purchase partial shares of high-priced stocks like Amazon or Apple.

The platform offers professional analytics tools and market sentiment indicators. Risk management features include stop-loss orders and position calculators.

Real-time market data and breaking news integration keep users informed. Customizable watchlists and push notifications enhance the mobile experience.

Comparing XTB’s Inactivity Fee Model with Competitor Practices

When selecting a brokerage service, comparing policies across different providers offers valuable perspective. Understanding how various platforms handle dormant accounts helps traders make informed choices.

Benchmarking Against Other Brokers

The £10 monthly charge after twelve months aligns with industry standards. eToro implements an identical structure with the same timeframe.

IG takes a different approach with a £12 monthly charge. However, their grace period extends to twenty-four months before charges begin.

XTB’s exemption for accounts holding physical assets represents a significant advantage. This policy benefits long-term investors who maintain stock or ETF positions.

Retail traders should evaluate their personal trading patterns when comparing brokers. Those taking extended breaks might prefer providers with longer grace periods.

The assessment should extend beyond dormant account charges. Total cost considerations include trading commissions, spreads, and additional services.

Interactive Brokers and Lynx cater to different trader profiles with advanced features. Their structures may better suit high-volume participants seeking extensive instrument selection.

Ultimately, matching broker policies to individual usage patterns ensures optimal value. Careful comparison helps traders avoid unnecessary costs while accessing suitable services.

Final Thoughts on Avoiding Unnecessary Charges and Maximizing Value

The true measure of a brokerage service lies in its ability to deliver sustainable value beyond mere transaction execution. For UK investors, this platform offers comprehensive solutions that extend well beyond basic trading functions.

Understanding the complete cost structure enables strategic account management. Maintaining physical assets like stocks or ETFs provides permanent protection while building long-term positions. The zero-commission structure for retail investors represents exceptional value.

This broker’s scale and regulatory oversight provide confidence in platform stability. Over 1.2 million clients trust this service with significant assets. Top-tier regulation ensures adherence to best practices.

Maximizing value involves leveraging automated Investment Plans, earning interest on cash balances, and utilizing educational resources. These features transform the platform from a simple execution venue into a comprehensive wealth-building tool.

The final recommendation emphasizes holistic utilization. Investors who understand the complete ecosystem and implement simple strategies achieve optimal outcomes. This approach delivers strong overall value for dedicated market participants.