XTB xstation5 app: Features and Benefits for Traders

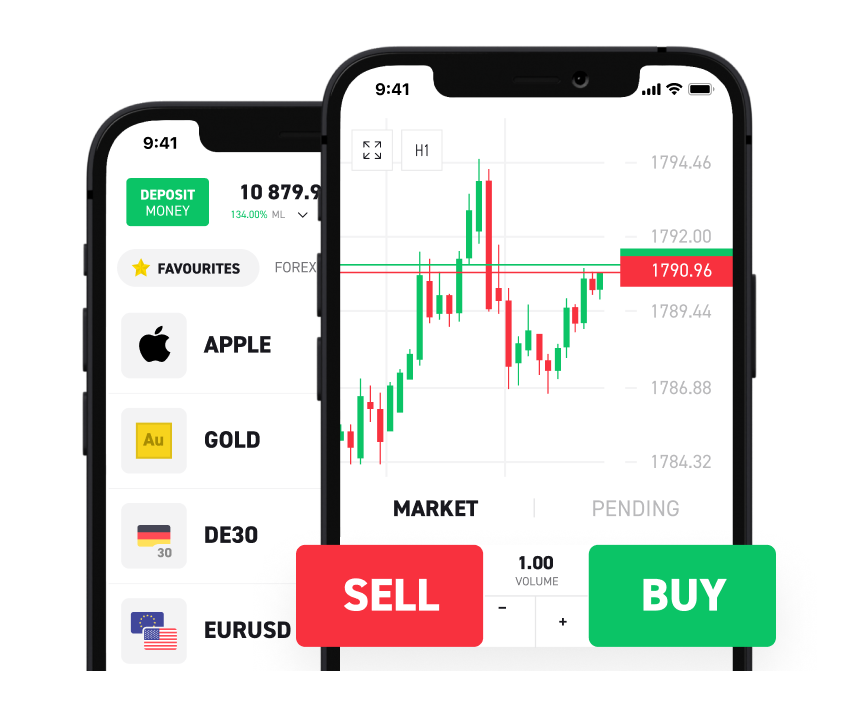

Mobile trading has transformed how investors interact with global markets. A versatile platform now allows users to manage portfolios, analyze trends, and execute trades from smartphones or tablets. With just an internet connection, traders gain access to thousands of financial instruments across Forex, commodities, and indices.

This solution stands out for its award-winning design, recognized by industry experts for intuitive navigation and reliability. It supports Android, iOS, and Windows devices, ensuring seamless performance regardless of operating system. The interface adapts perfectly to smaller screens, maintaining advanced charting tools and real-time data feeds.

Users benefit from direct access to over 3,000 markets, including ETFs and share CFDs contracts. Whether commuting or traveling, the platform keeps traders connected to opportunities. Newcomers appreciate simplified controls, while veterans leverage customizable dashboards for complex strategies.

To begin, individuals need only a stable connection and an active account. The blend of accessibility and sophistication makes this tool ideal for modern investors seeking flexibility without compromising functionality.

Introducing Mobile Trading and the XTB xstation5 Experience

Accessing global markets from a pocket-sized device has redefined what it means to be an investor. Traders now monitor trends, execute orders, and manage portfolios through platforms designed for speed and simplicity. This shift empowers users to act on opportunities instantly—whether at home or halfway across the world.

Overview of Mobile Trading Innovation

Modern solutions provide everything needed for informed decisions. Users can manage live or demo accounts, analyze charts with 30+ technical indicators, and track diverse assets like CFDs. The demo environment offers 100,000 in virtual funds—ideal for testing strategies without risk.

- Real-time price alerts and economic calendars

- One-tap order execution across 3,000+ markets

- Customizable watchlists for tracking favorites

The Journey from Desktop to Mobile

Desktop platforms once dominated trading, but mobile-first design changed the game. Over 50% of active traders now prefer handheld devices for their flexibility. Features like biometric login and offline mode ensure reliability, even with unstable connections—a critical factor for users in Vietnam’s dynamic urban centers.

This evolution reflects deeper changes in investing habits. Traders value tools that adapt to their lifestyles, not the other way around. Downloading a robust app takes minutes, and opening an account requires just an email and ID verification.

Exploring the “XTB xstation 5 app”: Key Features and Functionality

Traders now expect seamless interaction with global markets through intuitive mobile interfaces. The platform delivers this by combining broad market access with professional-grade analytics, empowering users to act decisively in fast-paced environments.

Access to Global Financial Markets

The platform connects users to over 3,000 financial instruments, spanning Forex pairs, stock indices, and commodity CFDs. Investors diversify portfolios by trading shares from leading companies or ETFs tracking major sectors. This variety ensures opportunities align with both short-term strategies and long-term goals.

Risk management stays streamlined through smartphone-adjusted orders. Traders modify stop-loss levels or take-profit targets in seconds, even during volatile sessions. Such flexibility proves vital when managing positions across time zones or unexpected market shifts.

Interactive Tools and Real-Time Analytics

Advanced charting tools transform smartphones into analysis hubs. Users apply 30+ technical indicators, draw trendlines, or compare multiple timeframes—all mirroring desktop capabilities. Custom alerts notify traders when assets hit specific price thresholds, ensuring no opportunity slips by.

Real-time news feeds and an economic calendar highlight events impacting positions. Bulk order features let users close several trades at once, saving time during rapid market movements. Combined with instant execution, these tools create a responsive environment for informed decisions.

Getting Started with Downloading and Setting Up the App

Modern traders demand tools that adapt to their pace. Installing a reliable platform takes minutes, yet unlocks professional-grade market access. This section guides users through setup essentials and risk-free learning opportunities.

Downloading the App and Creating Your Account

The process begins by visiting your device’s app store. Search for the platform and tap install—no complex configurations required. Upon launching, a clean login window greets users. Existing traders enter credentials to access live or demo modes instantly.

Newcomers can open account profiles directly within the app. The form requests basic details like email and phone number. Verification typically completes within hours, letting users explore features while waiting for approval.

Utilizing Demo Accounts for Risk-Free Practice

Demo mode provides 100,000 virtual dollars to test strategies. Experiment with orders, charts, and alerts without financial pressure. This sandbox environment mirrors real market conditions, helping users grasp how losses exceed expectations during volatility.

When ready to transition, the platform emphasizes invest responsibly principles. Clear warnings explain margin requirements and position risks. Funding options appear once identity verification finishes, maintaining regulatory compliance across regions.

Mastering Trade Execution and Chart Customization

Efficient trade execution separates successful strategies from missed opportunities. Modern platforms combine intuitive interfaces with professional tools, letting traders act swiftly while maintaining precision. Three core features help users optimize their workflow across diverse markets.

Placing Trades through Market Watch and Charting

The Market Watch window streamlines order placement. Double-click any instrument—like forex pairs or CFDs ETFs—to open a detailed trade interface. Users set position sizes, stop-loss limits, and profit targets in one window. An integrated calculator displays spreads, commissions, and swap costs upfront, helping traders assess risks before confirming orders.

For urgent opportunities, direct chart trading accelerates decisions. Buy/sell buttons on price graphs enable instant execution. This method keeps technical analysis visible while managing positions during volatile sessions.

Customizing Charts and Personalizing Workspaces

Right-clicking any chart opens the Personalise chart view menu. Traders adjust timeframes, apply 30+ indicators, or modify color schemes. Saved templates let users replicate proven setups across different instruments—ideal for comparing stocks and commodities.

Workspaces support up to 16 charts simultaneously. Professionals detach graphs across multiple screens, maintaining oversight of global markets. This flexibility suits Vietnam’s fast-paced trading culture, where tech-savvy investors monitor several assets at once.

Managing Orders with Built-In Calculators and Alerts

The platform prevents surprises with real-time cost breakdowns. Swap rates and pip values update dynamically as markets shift. Traders receive alerts when prices approach preset levels, reducing chances that losses exceed planned thresholds.

Modifying orders takes seconds directly from charts. Drag stop-loss lines or adjust take-profit zones while watching live price action. This integration ensures decisions align with evolving market conditions.

Maximizing Benefits and Next Steps for Successful Trading

Successful trading requires balancing opportunity with strategic planning. Financial instruments offer diverse options, from equities to CFDs, but carry risks where losses may exceed initial investments. Careful analysis of volatility and position sizing becomes essential before engaging with these markets.

Cost efficiency shines through zero commission stocks and ETF access, though a 0.5% currency conversion cost applies when trading cross-border assets. Traders exceeding monthly turnover 100,000 EUR thresholds often qualify for reduced fees on commission stocks ETFs, making volume management crucial for active participants.

Vietnamese investors should verify local tax rules, as regulations differ across regions. Hidden expenses like conversion cost may apply when dealing with multiple currencies, requiring thorough fee reviews during strategy development.

ETFs provide diversified exposure but demand disciplined risk controls. Maintaining minimum EUR balances ensures access to premium features while preserving liquidity for sudden market shifts.

Long-term success hinges on continuous learning and adapting strategies. By tracking monthly turnover patterns and optimizing currency exposure, traders minimize conversion-related expenses. Remember to invest responsibly—regular performance reviews and updated risk protocols separate sustainable growth from short-lived gains.